Take Alipay's Sesame credit as an example, its value range is 350-950 points. It is generally believed that the higher the score, the better the credit and the lower the default rate of personal business. Here is also a personal credit scoring tool similar to FICO scoring.

The idea of FICO scoring is: collect / analyze / convert a large number of user data with multiple attributes, use various statistical indicators (such as correlation coefficient / chi square check / variance expansion coefficient, etc.) to choose / copy / combine attributes, and finally get a quantitative / comprehensive / comparable score. On the one hand, the score reflects the quality of the user's historical credit record, on the other hand, it implies the possibility of default in the future.

The original data used here mainly includes the customer's personal information (including gender / age / job / marital status / educational status, etc.) / account information (including the number of various accounts / deposit and loan balance, etc.), as well as the classification label of whether the customer has defaulted.

After the data set is processed, it needs to go through the process of data box / attribute selection and the conversion between discrete classification labels and continuous credit scoring results.

I Import data

#Import package

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

#View raw data

data = pd.read_csv('credit.csv')

print('Raw data overview')

data.info()

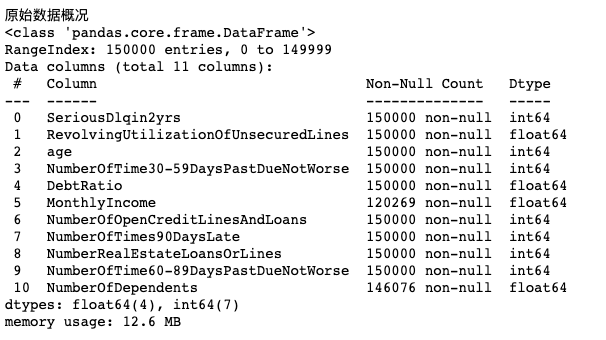

#The data is 12.6m and there are 11 attributes. There are two attributes, MonthlyIncome and NumberOfDependents, which have null values

The data is 12.6M and has 11 attributes. There are two attributes, MonthlyIncome and NumberOfDependents, which have null values

II Data cleaning

Because there are missing values in MonthlyIncome and NumberOfDependents, they need to be processed. The common method is 1 Fill in the blank with upper and lower values; 2. Fill in the blank with the attribute mean value. But each has its own shortcomings. A set is defined here_ Missing function is used to fill in the random forest regression algorithm to fill in the missing values.

#Data cleaning

#The random forest method is used to predict and fill the missing value of MonthlyIncome. Set is defined here_ Missing function

from sklearn.ensemble import RandomForestRegressor

def set_missing(df):

print('Random forest regression fill 0 value:')

process_df = df.iloc[:,[5,0,1,2,3,4,6,7,8,9]]

#Advance the monthly income in column 5 to column 0 as a label to facilitate subsequent data division

#They were divided into two groups with missing values

known = process_df.loc[process_df['MonthlyIncome']!=0].values

unknown = process_df.loc[process_df['MonthlyIncome']==0].values

X = known[:,1:]

y = known[:,0]

#Training random forest regression algorithm with x,y

rfr = RandomForestRegressor(random_state=0,n_estimators=200,max_depth=3,n_jobs=-1)

rfr.fit(X,y)

#The obtained model is used for missing value prediction

predicted = rfr.predict(unknown[:,1:]).round(0)

#The obtained prediction results fill the original missing data

df.loc[df['MonthlyIncome'] == 0,'MonthlyIncome'] = predicted

return df

Define outlier_ It is used to delete the outlier in the processing function

The method used here is data box Division: divide the value of the attribute into several segments (box), and replace the data falling within the same box with a unified value.

#Delete the outliers in the attribute, find out the outliers, and first calculate the maximum and minimum thresholds as the deletion criteria

#Minimum threshold = first quartile - 1.5 * (third quartile - first quartile)

#Maximum threshold = third quartile + 1.5 * (third quartile - first quartile)

# Rows with < minimum threshold and > maximum threshold are deleted

#Outlier defined_ The processing function is used to process outlier data points

def outlier_processing(df,cname):

s = df[cname]

onequater = s.quantile(0.25)

threequater = s.quantile(0.75)

irq = threequater - onequater

min = onequater - 1.5*irq

max = threequater + 1.5*irq

df = df[df[cname]<=max]

df = df[df[cname]>=min]

return df

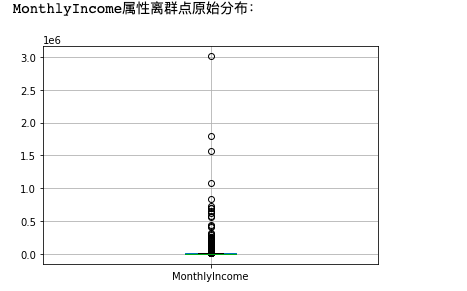

MonthlyIncome original distribution map and processed distribution map

#Data collation of MonthlyIncome column

print('MonthlyIncome Original distribution of attribute outliers:')

data[['MonthlyIncome']].boxplot()

plt.savefig('MonthlyIncome1.png',dpi = 300,bbox_inches = 'tight')

plt.show()

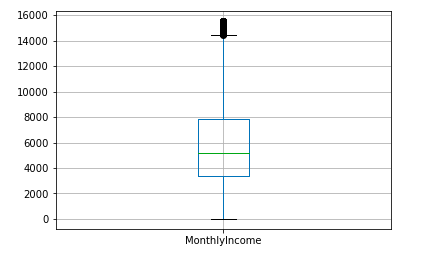

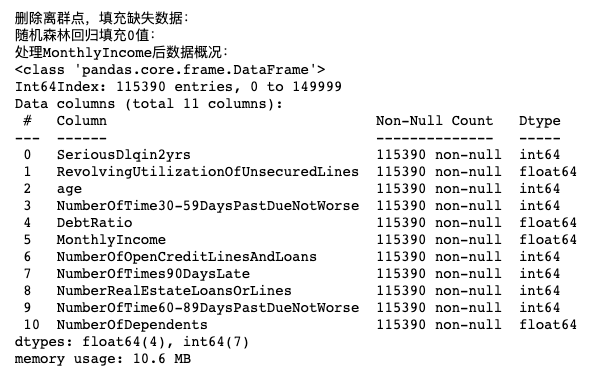

print('Delete outliers and fill in missing data:')

data = outlier_processing(data, 'MonthlyIncome')#Delete outliers

data = set_missing(data)#Fill in missing data

print('handle MonthlyIncome Post data overview:')

data.info()#View collated data

#image display

data[['MonthlyIncome']].boxplot()#Box diagram

plt.savefig('MonthlyIncome2.png',dpi = 300,bbox_inches = 'tight')

plt.show()

After deleting outliers and filling in missing data, the data set is 2M less

Similarly, outliers are processed for other attributes

#Similarly, outliers are processed for other attributes data = outlier_processing(data, 'age') data = outlier_processing(data, 'RevolvingUtilizationOfUnsecuredLines') data = outlier_processing(data, 'DebtRatio') data = outlier_processing(data, 'NumberOfOpenCreditLinesAndLoans') data = outlier_processing(data, 'NumberRealEstateLoansOrLines') data = outlier_processing(data, 'NumberOfDependents')

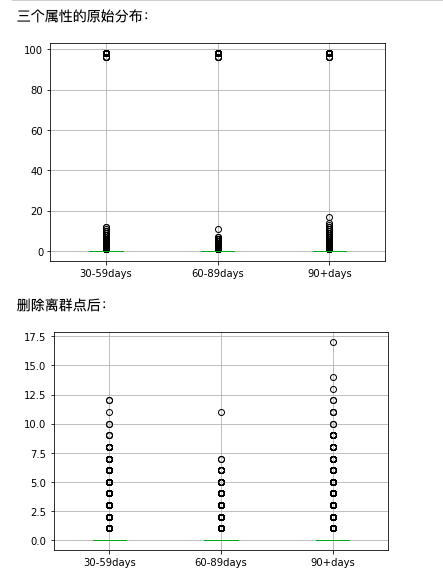

Manual processing is performed for three attributes with too concentrated values

#For three attributes whose values are too concentrated, the values of the three quartiles are equal, and the outlier is used directly_ The processing function causes all values to be deleted

#Therefore, these three attributes are processed manually

features = ['NumberOfTime30-59DaysPastDueNotWorse','NumberOfTime60-89DaysPastDueNotWorse','NumberOfTimes90DaysLate']

features_labels = ['30-59days','60-89days','90+days']

print('The original distribution of the three attributes:')

data[features].boxplot()

plt.xticks([1,2,3],features_labels)

plt.savefig('Original distribution of three attributes', dpi = 300 ,bbox_inches = 'tight')

plt.show()

print('After deleting outliers:')

data = data[data['NumberOfTime30-59DaysPastDueNotWorse']<90]

data = data[data['NumberOfTime60-89DaysPastDueNotWorse']<90]

data = data[data['NumberOfTimes90DaysLate']<90]

data[features].boxplot()

plt.xticks([1,2,3],features_labels)

plt.savefig('Distribution of three attributes after sorting', dpi = 300 ,bbox_inches = 'tight')

plt.show()

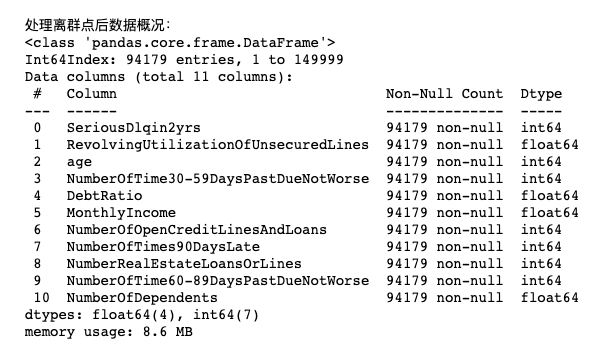

print('Data overview after processing outliers:')

data.info()

#Generate data sets and test sets

from sklearn.model_selection import train_test_split

#The original value 0 is normal and 1 is default. Because it is customary that the higher the credit score, the less likely the default is, so replace the original values of 0 and 1

data['SeriousDlqin2yrs'] = 1-data['SeriousDlqin2yrs']

Y = data['SeriousDlqin2yrs']

X = data.iloc[:,1:]

#Split training set and data set

X_train,X_test,Y_train,Y_test = train_test_split(X,Y,test_size=0.3,random_state = 0)

train = pd.concat([Y_train,X_train],axis = 1)

test = pd.concat([Y_test,X_test],axis = 1)

clasTest = test.groupby('SeriousDlqin2yrs')['SeriousDlqin2yrs'].count()

print('Training set data')

print(train.shape)

print('Test set data')

print(test.shape)

III Attribute selection

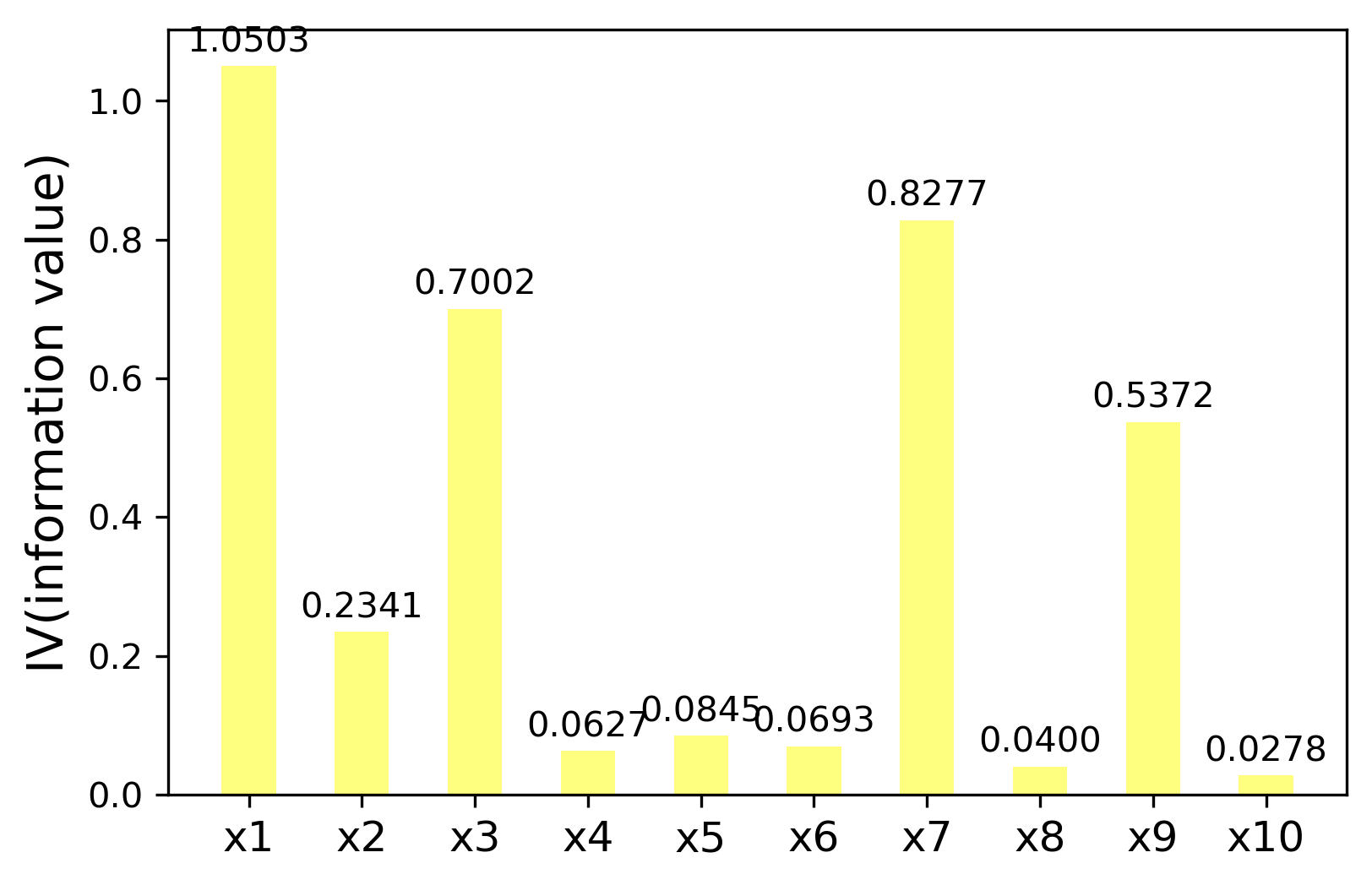

In addition to excluding attributes with small absolute value by correlation analysis, the importance of an attribute on the target variable can be investigated through two indicators: WoE(Weight of Evidence): indication weight and IV(Information Value): information value, so as to determine the choice of attributes.

The calculation formula of these two indicators is as follows:

WoE = In(pctlGood/pctlBad)

MIV = WoE*(pctlGood-pctlBad)

IV = ∑ MIV

The relationship between the value of information value IV and the target variable to be studied is:

0 < IV < 0.02 extremely weak

0.02 < = IV < 0.1 weak

0.1 < = IV < 0.03 general

0.3 < = IV < 0.5 strong

0.5 < = IV < 1.0 very strong

#Box the attributes and calculate the values of WOE and IV

#Box the attributes and calculate the values of WOE and IV

def mono_bin(res,feat,n = 10):

good = res.sum()

bad = res.count()-good

d1 = pd.DataFrame({'feat':feat,'res':res,'Bucket':pd.cut(feat,n)})

d2 = d1.groupby('Bucket',as_index = True)

d3 = pd.DataFrame(d2.feat.min(),columns = ['min'])

d3['min'] = d2.min().feat

d3['max'] = d2.max().feat

d3['sum'] = d2.sum().res

d3['total'] = d2.count().res

d3['rate'] = d2.mean().res

d3['woe'] = np.log((d3['rate']/(1-d3['rate']))/(good/bad))

d3['goodattribute'] = d3['sum']/good

d3['badattribute'] = (d3['total']-d3['sum'])/bad

iv = ((d3['goodattribute']-d3['badattribute'])*d3['woe']).sum()

d4 = (d3.sort_values(by = 'min'))

cut = []

cut.append(float('-inf'))

for i in range(1,n):

qua = feat.quantile(i/(n))

cut.append(round(qua,4))

cut.append(float('inf'))

woe = list(d4['woe'].round(3))

return d4,iv,cut,woe

def self_bin(res,feat,cat):

good = res.sum()

bad = res.count()-good

d1 = pd.DataFrame({'feat':feat,'res':res,'Bucket':pd.cut(feat,cat)})

d2 = d1.groupby('Bucket',as_index = True)

d3 = pd.DataFrame(d2.feat.min(),columns = ['min'])

d3['min'] = d2.min().feat

d3['max'] = d2.max().feat

d3['sum'] = d2.sum().res

d3['total'] = d2.count().res

d3['rate'] = d2.mean().res

d3['woe'] = np.log((d3['rate']/(1-d3['rate']))/(good/bad))

d3['goodattribute'] = d3['sum']/good

d3['badattribute'] = (d3['total']-d3['sum'])/bad

iv = ((d3['goodattribute']-d3['badattribute'])*d3['woe']).sum()

d4 = (d3.sort_values(by = 'min'))

woe = list(d4['woe'].round(3))

return d4,iv,woe

Each attribute is divided into boxes according to the specified interval. cutx3/6/7/8/910 boxes are defined here

pinf = float('inf')

ninf = float('-inf')

dfx1,ivx1,cutx1,woex1 = mono_bin(train['SeriousDlqin2yrs'],train['RevolvingUtilizationOfUnsecuredLines'],n = 10)

#Display the information of revolutionutilizationofunsecure lines and WOE

print('='*60)

print('display RevolvingUtilizationOfUnsecuredLines Sub box and WOE information:')

print(dfx1)

dfx2,ivx2,cutx2,woex2 = mono_bin(train['SeriousDlqin2yrs'],train['age'],n = 10)

dfx4,ivx4,cutx4,woex4 = mono_bin(train['SeriousDlqin2yrs'],train['DebtRatio'],n = 10)

dfx5,ivx5,cutx5,woex5 = mono_bin(train['SeriousDlqin2yrs'],train['MonthlyIncome'],n = 10)

#Divide the data of 3, 6, 7, 8, 9 and 10 columns into boxes at specified intervals

cutx3 = [ninf,0,1,3,5,pinf]

cutx6 = [ninf,1,2,3,5,pinf]

cutx7 = [ninf,0,1,3,5,pinf]

cutx8 = [ninf,0,1,2,3,pinf]

cutx9 = [ninf,0,1,3,pinf]

cutx10 = [ninf,0,1,2,3,5,pinf]

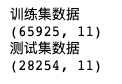

#Divide the numberoftime30-59dayspastduenotword attribute into 5 segments according to the interval specified by cutx3

dfx3,ivx3,woex3 = self_bin(train['SeriousDlqin2yrs'],train['NumberOfTime30-59DaysPastDueNotWorse'],cutx3)

#Display NumberOfTime30-59DaysPastDueNotWorse distribution box and woe information:

print('='*60)

print('NumberOfTime30-59DaysPastDueNotWorse Sub box and woe Information:')

print(dfx3)

dfx6,ivx6,woex6 = self_bin(train['SeriousDlqin2yrs'],train['NumberOfOpenCreditLinesAndLoans'],cutx6)

dfx7,ivx7,woex7 = self_bin(train['SeriousDlqin2yrs'],train['NumberOfTimes90DaysLate'],cutx7)

dfx8,ivx8,woex8 = self_bin(train['SeriousDlqin2yrs'],train['NumberRealEstateLoansOrLines'],cutx8)

dfx9,ivx9,woex9 = self_bin(train['SeriousDlqin2yrs'],train['NumberOfTime60-89DaysPastDueNotWorse'],cutx9)

dfx10,ivx10,woex10 = self_bin(train['SeriousDlqin2yrs'],train['NumberOfDependents'],cutx10)

Draw the calculated IV attribute

#Select properties by iv

ivlist = [ivx1,ivx2,ivx3,ivx4,ivx5,ivx6,ivx7,ivx8,ivx9,ivx10]

index = ['x1','x2','x3','x4','x5','x6','x7','x8','x9','x10']

fig1 = plt.figure(1)

ax1 = fig1.add_subplot(1,1,1)

x = np.arange(len(index))+1

ax1.bar(x,ivlist,width = 0.48,color = 'yellow',alpha = 0.5)

ax1.set_xticks(x)

ax1.set_xticklabels(index,rotation = 0,fontsize = 12)

ax1.set_ylabel('IV(information value)',fontsize = 14)

for a,b in zip(x,ivlist):

plt.text(a,b+0.01,'%.4f'%b,ha = 'center',va = 'bottom',fontsize = 10)

plt.savefig('iv Value.png', dpi = 300,bbox_inches = 'tight')

plt.show()

IV Model training stage

Get defined_ The WoE function is used to convert the original data into WoE values to improve the training results of the model. Call get_wor function, which converts the attributes of training set and test set into WoE value

#Model training stage

#Find the corresponding value of the attribute woe

def get_woe(feat,cut,woe):

res = []

for row in feat.iteritems():

value = row[1]

j = len(cut)-2

m = len(cut)-2

while j>=0:

if value>=cut[j]:

j=-1

else:

j-=1

m-=1

res.append(woe[m])

return res

#Call get_ The woe function converts the attribute values of the training set and the test set into woe values respectively

woe_train = pd.DataFrame()

woe_train['SeriousDlqin2yrs'] = train['SeriousDlqin2yrs']

woe_train['RevolvingUtilizationOfUnsecuredLines'] = get_woe(train['RevolvingUtilizationOfUnsecuredLines'], cutx1, woex1)

woe_train['age'] = get_woe(train['age'], cutx2, woex2)

woe_train['NumberOfTime30-59DaysPastDueNotWorse'] = get_woe(train['NumberOfTime30-59DaysPastDueNotWorse'], cutx3, woex3)

woe_train['DebtRatio'] = get_woe(train['DebtRatio'], cutx4, woex4)

woe_train['MonthlyIncome'] = get_woe(train['MonthlyIncome'], cutx5, woex5)

woe_train['NumberOfOpenCreditLinesAndLoans'] = get_woe(train['NumberOfOpenCreditLinesAndLoans'], cutx6, woex6)

woe_train['NumberOfTimes90DaysLate'] = get_woe(train['NumberOfTimes90DaysLate'], cutx7, woex7)

woe_train['NumberRealEstateLoansOrLines'] = get_woe(train['NumberRealEstateLoansOrLines'], cutx8, woex8)

woe_train['NumberOfTime60-89DaysPastDueNotWorse'] = get_woe(train['NumberOfTime60-89DaysPastDueNotWorse'], cutx9, woex9)

woe_train['NumberOfDependents'] = get_woe(train['NumberOfDependents'], cutx10, woex10)

#Replace the attributes of the test set with woe

woe_test = pd.DataFrame()

woe_test['SeriousDlqin2yrs'] = train['SeriousDlqin2yrs']

woe_test['RevolvingUtilizationOfUnsecuredLines'] = get_woe(train['RevolvingUtilizationOfUnsecuredLines'], cutx1, woex1)

woe_test['age'] = get_woe(train['age'], cutx2, woex2)

woe_test['NumberOfTime30-59DaysPastDueNotWorse'] = get_woe(train['NumberOfTime30-59DaysPastDueNotWorse'], cutx3, woex3)

woe_test['DebtRatio'] = get_woe(train['DebtRatio'], cutx4, woex4)

woe_test['MonthlyIncome'] = get_woe(train['MonthlyIncome'], cutx5, woex5)

woe_test['NumberOfOpenCreditLinesAndLoans'] = get_woe(train['NumberOfOpenCreditLinesAndLoans'], cutx6, woex6)

woe_test['NumberOfTimes90DaysLate'] = get_woe(train['NumberOfTimes90DaysLate'], cutx7, woex7)

woe_test['NumberRealEstateLoansOrLines'] = get_woe(train['NumberRealEstateLoansOrLines'], cutx8, woex8)

woe_test['NumberOfTime60-89DaysPastDueNotWorse'] = get_woe(train['NumberOfTime60-89DaysPastDueNotWorse'], cutx9, woex9)

woe_test['NumberOfDependents'] = get_woe(train['NumberOfDependents'], cutx10, woex10)

import statsmodels.api as sm

from sklearn.metrics import roc_curve,auc

Y = woe_train['SeriousDlqin2yrs']

X = woe_train.drop(['SeriousDlqin2yrs','DebtRatio','MonthlyIncome','NumberOfOpenCreditLinesAndLoans','NumberRealEstateLoansOrLines','NumberOfDependents'],axis = 1)

X1 = sm.add_constant(X)

logit = sm.Logit(Y,X1)

Logit_model = logit.fit()

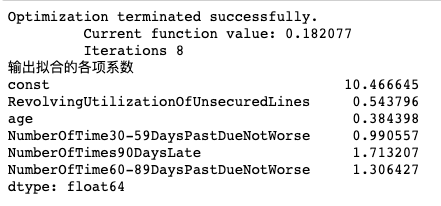

print('Output fitting coefficients')

print(Logit_model.params)

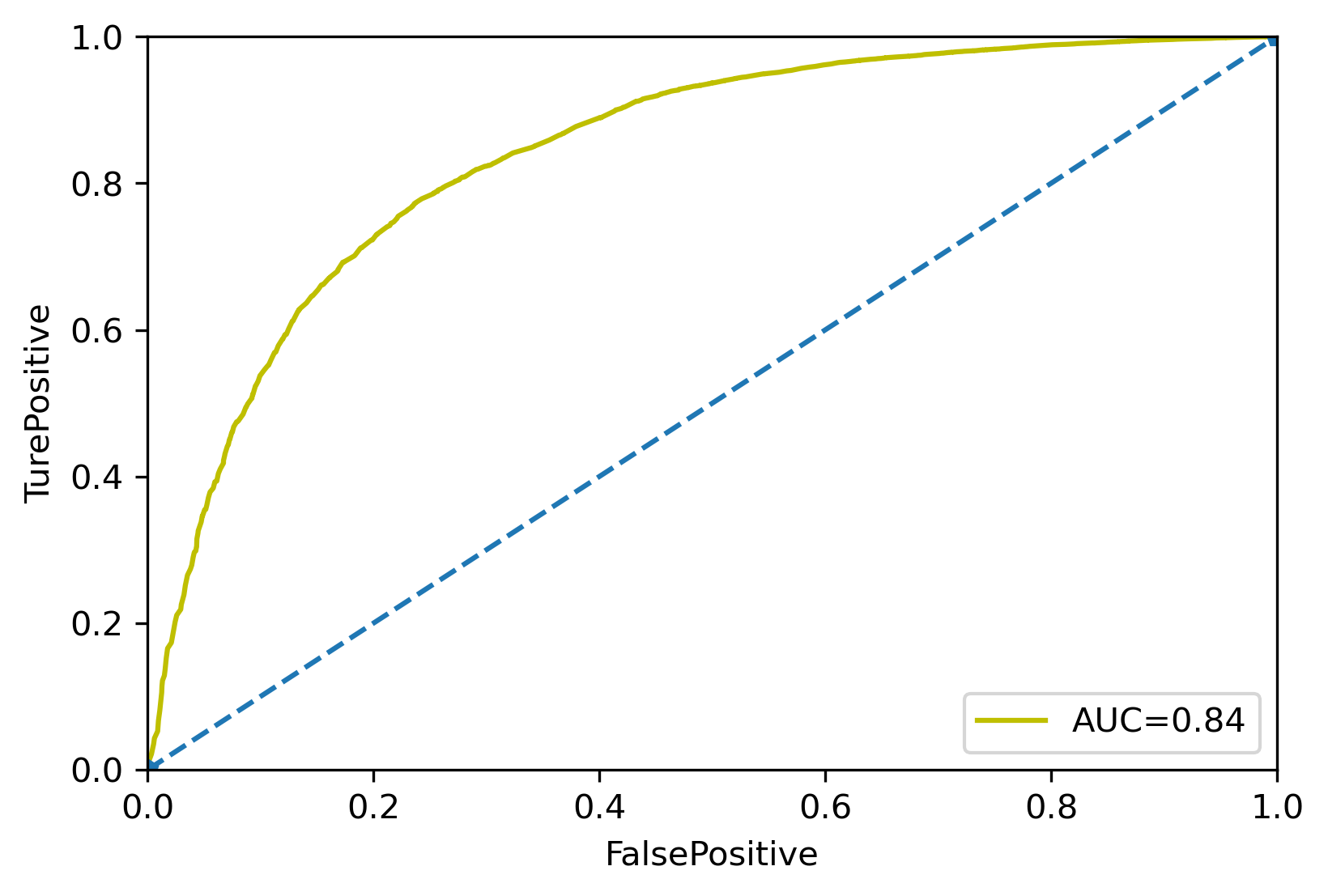

Draw the AUC curve of the model

Y_test = woe_test['SeriousDlqin2yrs']

X_test = woe_test.drop(['SeriousDlqin2yrs','DebtRatio','MonthlyIncome',

'NumberOfOpenCreditLinesAndLoans',

'NumberRealEstateLoansOrLines','NumberOfDependents'],axis=1)

X3 = sm.add_constant(X_test)

resu = Logit_model.predict(X3)

fpr,tpr,threshold = roc_curve(Y_test,resu)

rocauc = auc(fpr,tpr)

plt.plot(fpr,tpr,'y',label='AUC=%0.2f' % rocauc)

plt.legend(loc='lower right')

plt.plot([0,1],[0,1],'p--')

plt.xlim([0,1])

plt.ylim([0,1])

plt.ylabel('TurePositive')

plt.xlabel('FalsePositive')

plt.savefig('Model AUC curve.png',dpi=300,bbox_inches='tight')

print('Model AUC Curve:')

plt.show()

#Define get_ The score function is used to calculate the basic score of each sub box

def get_score(coe,woe,factor):

scores = []

for w in woe:

score = round(coe*w*factor,0)

scores.append(score)

return scores

#Define compte_score function to calculate the basic score corresponding to the specific attribute value

def compute_score(feat,cut,score):

res = []

for row in feat.iteritems():

value = row[1]

j = len(cut)-2

m = len(cut)-2

while j>=0:

if value>=cut[j]:

j=-1

else:

j-=1

m-=1

res.append(score[m])

return res

import math

coe = Logit_model.params

p = 20/math.log(2)

q = 600-20*math.log(20)/math.log(2)

baseScore = round(q+p*coe[0],0)

x1 = get_score(coe[1],woex1,p)

print('The attribute value in column 1 is the score corresponding to each sub box section')

print(x1)

x2 = get_score(coe[2],woex2,p)

x3 = get_score(coe[3],woex3,p)

x7 = get_score(coe[4],woex7,p)

x9 = get_score(coe[5],woex9,p)

#print(x2)

#print(x3)

#print(x3)

#Calculate score

test['BaseScore'] = np.zeros(len(test))+baseScore

test['x1'] = compute_score(test['RevolvingUtilizationOfUnsecuredLines'],cutx1,x1)

test['x2'] = compute_score(test['age'],cutx2,x2)

test['x3'] = compute_score(test['NumberOfTime30-59DaysPastDueNotWorse'],cutx3,x3)

test['x7'] = compute_score(test['NumberOfTimes90DaysLate'],cutx7,x7)

test['x9'] = compute_score(test['NumberOfTime60-89DaysPastDueNotWorse'],cutx9,x9)

test['Score'] = test['x1']+test['x2']+test['x3']+test['x7']+test['x9']+baseScore

The attribute value in column 1 is the score corresponding to each sub box section

[20.0, 10.0, 4.0, -2.0, -7.0, -13.0, -19.0, -21.0, -41.0, -38.0]

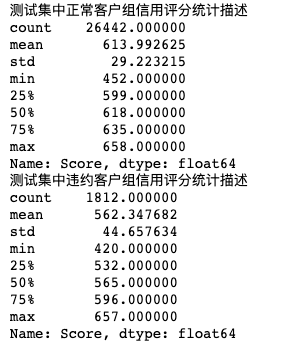

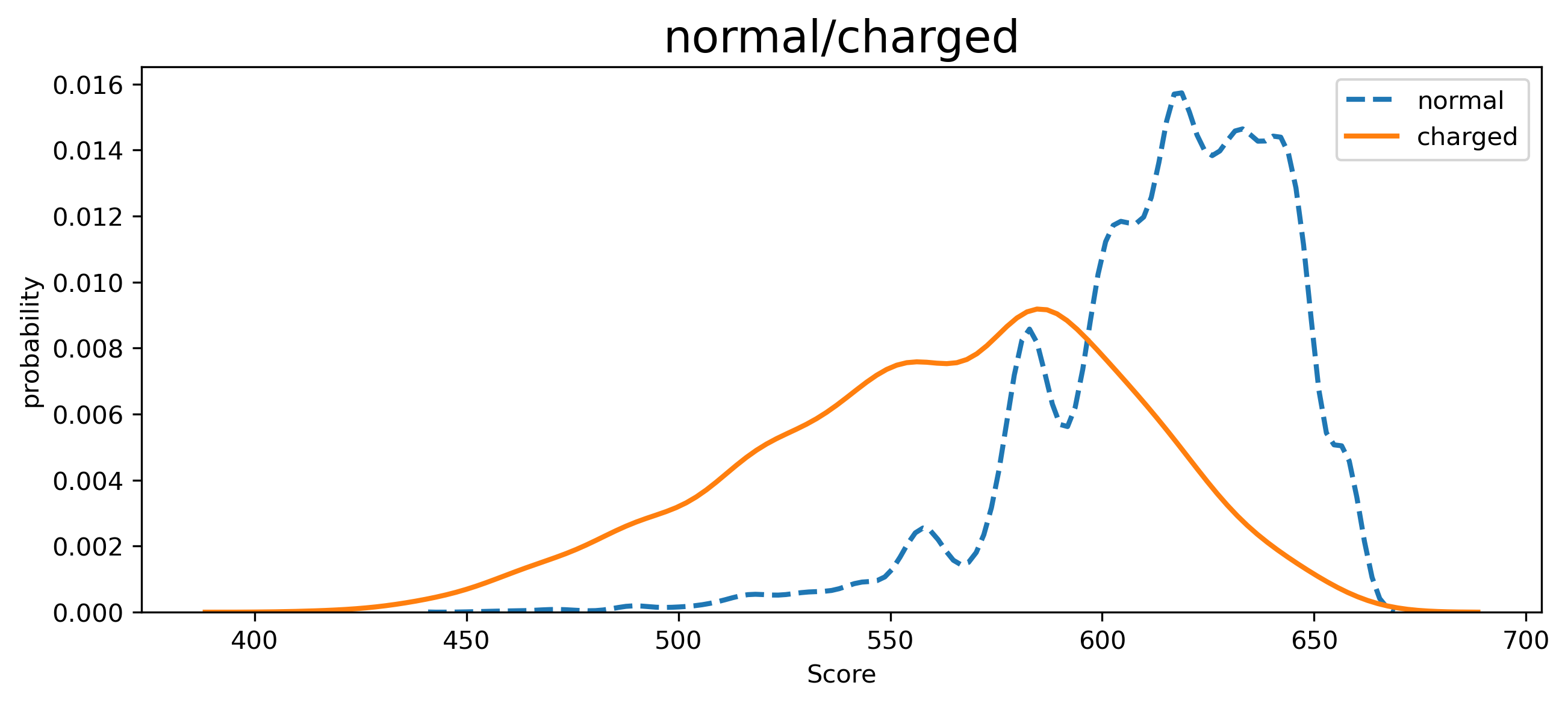

Normal = test.loc[test['SeriousDlqin2yrs']==1]

Charged = test.loc[test['SeriousDlqin2yrs']==0]

print('Statistical description of credit scores of normal customer groups in the test set')

print(Normal['Score'].describe())

print('Statistical description of credit score of default customer group in the test set')

print(Charged['Score'].describe())

import seaborn as sns

plt.figure(figsize = (10,4))

sns.kdeplot(Normal['Score'],label = 'normal',linewidth = 2,linestyle = '--')

sns.kdeplot(Charged['Score'],label = 'charged',linewidth = 2,linestyle = '-')

plt.xlabel('Score',fontdict = {'size':10})

plt.ylabel('probability',fontdict = {'size':10})

plt.title('normal/charged',fontdict={'size':18})

plt.savefig('Credit distribution of default and normal customers.png',dpi = 300,bbox_inches = 'tight')

plt.show()

Credit score distribution of defaulting customers and normal customers

Apply the trained model to customer credit scoring

#Apply the trained model to customer credit scoring

cusInfo = {'RevolvingUtilizationOfUnsecuredLines':0.248537,'age':48,'NumberOfTime30-59DaysPastDueNotWorse':0,

'NumberOfTime60-89DaysPastDueNotWorse':0,'DebtRatio':0.177586,'MonthlyIncome':4166,

'NumberOfOpenCreditLinesAndLoans':11,'NumberOfTimes90DaysLate':0,'NumberRealEstateLoansOrLines':1,

'NumberOfTime60-89DaysPastDueNotWorse':0,'NumberOfDependents':0}

custData = pd.DataFrame(cusInfo,pd.Index(range((1))))

custData.drop(['DebtRatio','MonthlyIncome','NumberOfOpenCreditLinesAndLoans','NumberRealEstateLoansOrLines','NumberOfDependents'],axis = 1)

custData['x1'] = compute_score(custData['RevolvingUtilizationOfUnsecuredLines'], cutx1,x1)

custData['x2'] = compute_score(custData['age'], cutx2,x2)

custData['x3'] = compute_score(custData['NumberOfTime30-59DaysPastDueNotWorse'], cutx3,x3)

custData['x7'] = compute_score(custData['NumberOfTimes90DaysLate'], cutx7,x7)

custData['x9'] = compute_score(custData['NumberOfTime60-89DaysPastDueNotWorse'], cutx9,x9)

custData['Score'] = custData['x1']+custData['x2']+custData['x3']+custData['x7']+custData['x9']+baseScore

print('The customer's credit score is:')

print(custData.loc[0,'Score'])

The customer's credit score is:

613.0