This forecast relates to the marketing activities of Portuguese banking institutions. These marketing activities are generally based on telephone. The customer service personnel of the bank contact the customer at least once to confirm whether the customer is willing to buy the bank's products (time deposit). The basic type of task is classified task, which is to predict whether the customer will buy the bank's products.

Related package

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

import warnings

warnings.filterwarnings("ignore")

from sklearn import ensemble,

from sklearn import model_selection

from sklearn import multiclass

from sklearn.model_selection import cross_val_score

from sklearn.preprocessing import OneHotEncoder, LabelEncoder

from sklearn.metrics import roc_curve, auc,roc_auc_score

from sklearn.metrics import classification_report, confusion_matrix

from sklearn.metrics import confusion_matrix

from sklearn.metrics import ConfusionMatrixDisplay

from sklearn.model_selection import GridSearchCV

from imblearn.over_sampling import SMOTE

from scipy.stats import chi2_contingency

Data preprocessing

Data import

train_set = pd.read_csv('train_set.csv')

test_set = pd.read_csv('test_set.csv')

print(train_set.shape)

print(test_set.shape)

#(25317, 18)

#(10852, 17)

#train_set.info()

#test_set.info()

Data field

ID: customer unique ID

Age: age

job: position

Marital: marital status

education: education

Default: whether there is a default record

Balance: the average balance of the account every year

Housing: is there a housing loan

Loan: is there a personal loan

contact: communication with customers

Last contact date: day

Month: the month of the last contact

Duration: the communication duration of the last contact

campaign: the number of exchanges with customers in this activity

pdays: how long has it been since the last time the customer was contacted in the last activity (999 means no contact)

previous: the number of times we communicated with the customer before this activity

poutcome: the result of the last activity

y: Predict whether customers will order time deposit business

Duplicate value processing

test_set = test_set.drop_duplicates() train_set = train_set.drop_duplicates() print(train_set.shape) print(test_set.shape) #(25317, 18) #(10852, 17) #The data has no duplicate values

Missing value processing

#The data has no NA value but has an unknow n value train_set.isin(['unknown']).mean()*100 #job:0.643836,education:4.206660,contact:28.759332,poutcome:81.672394 test_set.isin(['unknown']).mean()*100 #job:0.552893,education:4.128271,contact:28.676742,poutcome:81.800590 # Work, education and communication methods are filled with modes. The result of the last communication is poutcome. This feature is abandoned because there are too many deficiencies train_set.drop(['poutcome'],inplace=True,axis=1) train_set['job'].replace(['unknown'],train_set['job'].mode(),inplace=True) train_set['education'].replace(['unknown'],train_set['education'].mode(),inplace=True) train_set['contact'].replace(['unknown'],train_set['contact'].mode(),inplace=True) test_set.drop(['poutcome'],inplace=True,axis=1) test_set['job'].replace(['unknown'],test_set['job'].mode(),inplace=True) test_set['education'].replace(['unknown'],test_set['education'].mode(),inplace=True) test_set['contact'].replace(['unknown'],test_set['contact'].mode(),inplace=True)

Exploratory analysis

#Discrete variable column name object_columns = ['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact','month'] #Continuous variable column name num_columns = ['age', 'balance', 'duration', 'campaign', 'pdays', 'previous','day']

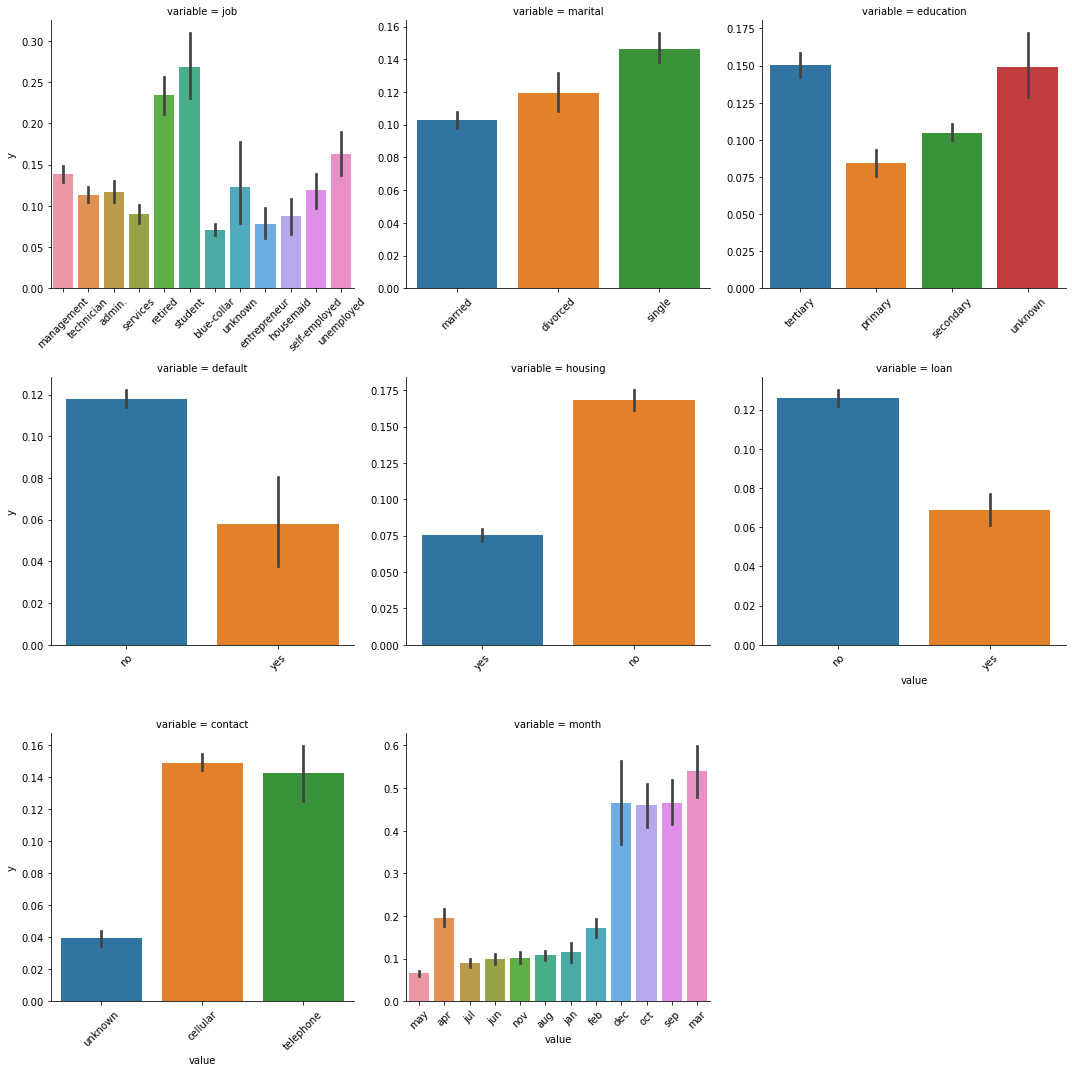

discrete variable

def barplot(x,y, **kwargs):

sns.barplot(x=x , y=y)

x = plt.xticks(rotation=45)

f = pd.melt(train_set, value_vars=object_columns ,id_vars = 'y')

g = sns.FacetGrid(f, col="variable", col_wrap=3, sharex=False, sharey=False, size=5)

g = g.map(barplot,"value",'y')

Position: retirees and students are more likely to buy time deposits, followed by the unemployed and managers, and the willingness of blue collar fixed-term financial management is lower

Marital status: single people are more willing to manage money regularly than divorced and married people

Education level: the willingness of regular financial management is reduced according to the education level of University, high school and junior middle school

Whether there is a default record: people without a default record are twice as likely to buy regular financial management as those with a default record

Whether there is housing loan: people without housing loan may buy fixed-term financial management more than twice as much as those with housing loan

Whether there is personal loan: people without personal loan are more likely to buy fixed-term financial management

Communication with customers: communication by telephone and mobile phone has no obvious impact on customers' decision to purchase time deposits

The last contact month: December, October, September and March, the proportion of time deposits purchased is high

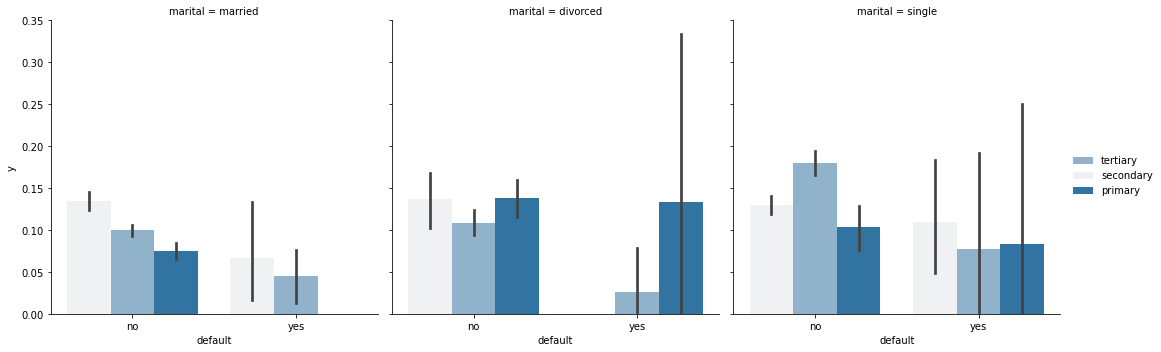

g = sns.FacetGrid(train_set, col='marital',size=5) g.map(sns.barplot, 'default', 'y', 'education') g.add_legend()

Single people with no record of default and college degree are more likely to buy time deposits

People with divorce, a record of default and a college degree are less likely to buy time deposits

def barplot(x,y, **kwargs):

sns.barplot(x=x , y=y)

x=plt.xticks(rotation=90)

plt.figure(figsize=(16, 12))

g = sns.FacetGrid(train_set, col='education',col_order=['primary','secondary','tertiary'],size=5)

g.map(barplot, 'job', 'y')

With the improvement of educational background, the willingness of retirees and blue collar workers to buy regular financial management increases, while the willingness of students to buy regular financial management decreases

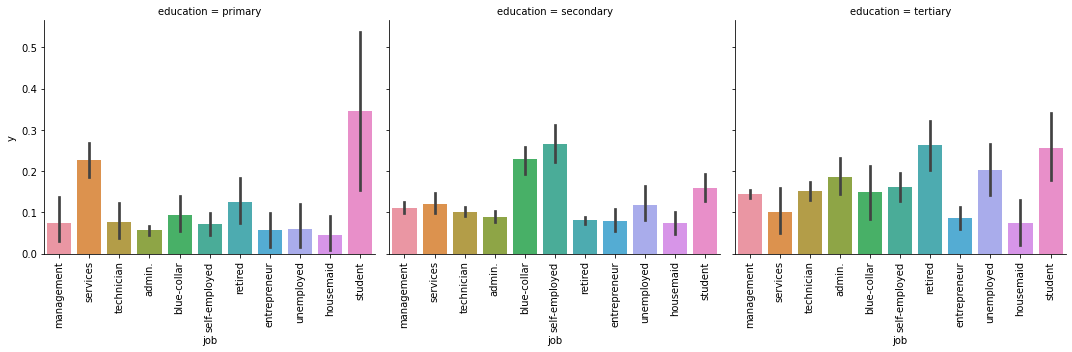

continuous variable

f = pd.melt(train_set, value_vars=num_columns ,id_vars = 'y') g = sns.FacetGrid(f, col="variable", col_wrap=3, sharex=False, sharey=False, size=5,hue='y') g = g.map(sns.distplot,"value",bins=20) g.add_legend()

Age: more willing to buy regular financial products before the age of 30, less willing to buy regular financial products at the age of 30-60, and significantly more likely to buy regular financial products after the age of 60

Communication duration: the rate of purchasing fixed-term financial management increased after about 300 minutes of communication

Number of communication with customers in this activity: the increase of communication times can not significantly improve the ratio of customers to buy regular financial management

How long has it been since the last time the customer was contacted in the last activity: in 140-160180-200 days, the rate of customers purchasing regular financial management has increased significantly

Number of communication with the customer before this activity: the increase of communication times can not significantly improve the ratio of customers to buy regular financial management, which may be counterproductive

Date: there will be three peak purchases of regular financial management every month, and customers least want to buy regular financial management on the 23rd-25th of each month

Characteristic Engineering

descriptive statistics

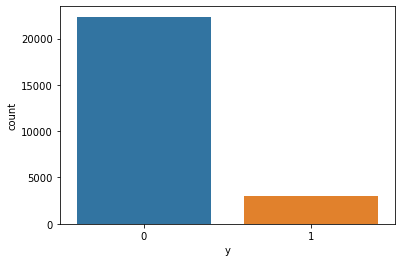

sns.countplot(train_set['y']) #If the data distribution is unbalanced, up sampling can be used to solve the problem of sample imbalance

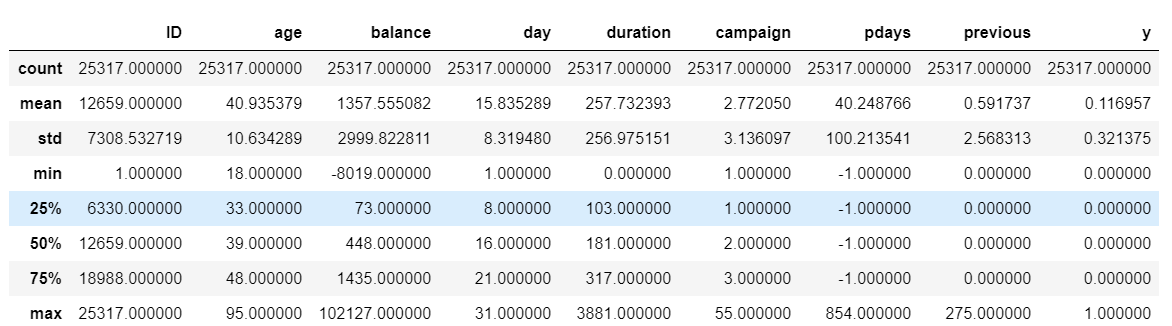

#descriptive statistics train_set.describe() test_set.describe()

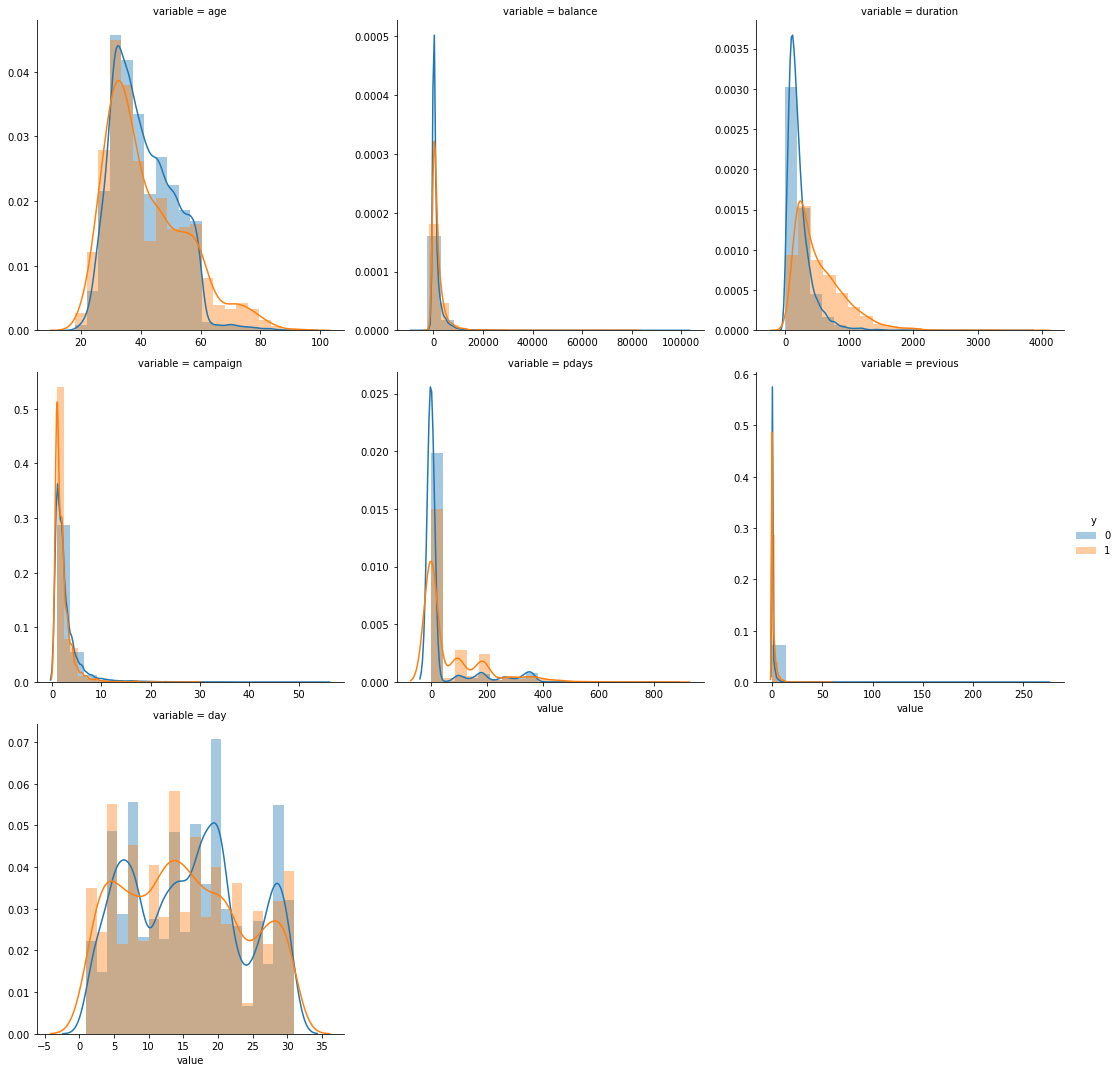

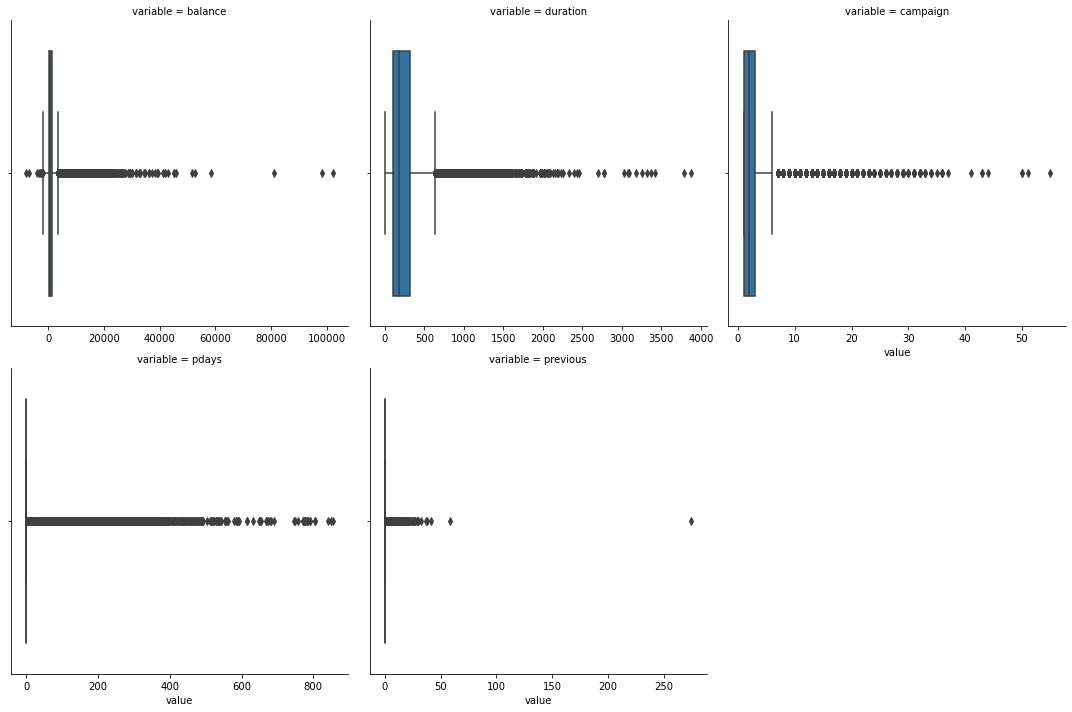

#Distribution of data categorical_features = ['balance','duration','campaign','pdays','previous'] f = pd.melt(train_set, value_vars=categorical_features,id_vars=['y']) g = sns.FacetGrid(f, col="variable", col_wrap=3, sharex=False, sharey=False, size=5) g = g.map(sns.boxplot, "value")

It can be seen that there are many extreme values of data. Deleting extreme values will have a certain impact on the source data. The data will be processed in boxes later

Characteristic structure

#View the values of category variables

for column in object_columns:

print(column,': ',train_set[column].unique())

#job : ['management' 'technician' 'admin.' 'services' 'retired' 'student' 'blue-collar' 'entrepreneur' 'housemaid' 'self-employed' 'unemployed']

#marital : ['married' 'divorced' 'single']

#education : ['tertiary' 'primary' 'secondary']

#default : ['no' 'yes']

#housing : ['yes' 'no']

#loan : ['no' 'yes']

#contact : ['cellular' 'telephone']

#month : ['may' 'apr' 'jul' 'jun' 'nov' 'aug' 'jan' 'feb' 'dec' 'oct' 'sep' 'mar']

#Characteristics of structural quarter and half year

def quarter(data):

a = ''

if data in ['jan','feb','mar']:

a = 'Q1'

elif data in ['apr','may','jun']:

a = 'Q2'

elif data in ['jul','aug','sep']:

a = 'Q3'

else:

a = 'Q4'

return a

def halfyear(data):

a = ''

if data in ['jan','feb','mar','apr','may','jun']:

a = 'H1'

else:

a = 'H2'

return a

The discrete data is encoded and the continuous data is divided into boxes. The methods of box division include equivalence, equal width, clustering, chi square, minimum entropy, etc. Here, qcut and cut are selectively used to divide the data according to the characteristics of the data, and the number of boxes is determined by woe and iv values.

def CalcWOE(df, col, target):

'''

: df dataframe

: col Note that this column has been divided into boxes. Now calculate the weight of each box WOE And overall IV

: target Target column 0-1 value

: return Return each box WOE And overall IV

'''

total = df.groupby([col])[target].count()

total = pd.DataFrame({'total': total})

bad = df.groupby([col])[target].count() - df.groupby([col])[target].sum()

bad = pd.DataFrame({'bad': bad})

regroup = total.merge(bad, left_index=True, right_index=True, how='left')

regroup.reset_index(level=0, inplace=True)

N = sum(regroup['total'])

B = sum(regroup['bad'])

regroup['good'] = regroup['total'] - regroup['bad']

G = N - B

regroup['bad_pcnt'] = regroup['bad'].map(lambda x: x * 1.0 / B)

regroup['good_pcnt'] = regroup['good'].map(lambda x: x * 1.0 / G)

regroup['WOE'] = regroup.apply(

lambda x: np.log(x.good_pcnt * 1.0 / x.bad_pcnt), axis=1)

WOE_dict = regroup[[col, 'WOE']].set_index(col).to_dict(orient='index')

IV = regroup.apply(

lambda x:

(x.good_pcnt - x.bad_pcnt) * np.log(x.good_pcnt * 1.0 / x.bad_pcnt),

axis=1)

IV_SUM = sum(IV)

return {'WOE': WOE_dict, 'IV_sum': IV_SUM, 'IV': IV}

#Judge whether woe satisfies monotonicity

def BadRateMonotone(df, sortByVar, target):

#df[sortByVar] this column has been divided into boxes

df2 = df.sort_values(by=[sortByVar])

total = df2.groupby([sortByVar])[target].count()

total = pd.DataFrame({'total': total})

bad = df2.groupby([sortByVar])[target].count() - df2.groupby(

[sortByVar])[target].sum()

bad = pd.DataFrame({'bad': bad})

regroup = total.merge(bad, left_index=True, right_index=True, how='left')

regroup.reset_index(level=0, inplace=True)

combined = zip(regroup['total'], regroup['bad'])

badRate = [x[1] * 1.0 / x[0] for x in combined]

badRateMonotone = [

badRate[i] < badRate[i + 1] for i in range(len(badRate) - 1)

]

Monotone = len(set(badRateMonotone))

if Monotone == 1:

return True

else:

return False

def num_band(df, columns, target, min_num, max_num):

result = []

for col in columns:

for i in range(min_num, max_num):

try:

df['band'] = pd.cut(df[col], i)

WOE_IV = CalcWOE(df, 'band', target)

T_F = BadRateMonotone(df, 'band', target)

result.append([col, i, WOE_IV['IV_sum'], T_F])

except:

continue

return pd.DataFrame(result, columns=['column', 'num', 'IV_sum', 'T_F'])

num_band(train_set, num_columns, 'y', 2, 10)

#Select woe the number of bins with monotonicity and maximum IV value

for dataset in [train_set]:

dataset['balanceBin'] = pd.qcut(dataset['balance'], 5)

dataset['ageBin'] = pd.cut(dataset['age'].astype(int), [0, 30, 60, 100])

dataset['quarter'] = dataset['month'].map(quarter)

dataset['halfyear'] = dataset['month'].map(halfyear)

dataset['dayBin'] = pd.cut(dataset['day'], 2)

dataset['durationBin'] = pd.qcut(dataset['duration'], 9)

dataset['campaignBin'] = pd.qcut(dataset['campaign'], 2)

dataset['pdaysBin'] = pd.cut(dataset['pdays'], 9)

dataset['previousBin'] = pd.cut(dataset['previous'], 9)

dataset['all_previous'] = dataset['campaign'] + dataset['previous']

dataset['all_previousBin'] = pd.cut(dataset['all_previous'], 2)

Feature screening

Judge the maximum proportion of each category (box division result) in the overall proportion. If the proportion of a category exceeds 95%, it indicates that this feature is seriously skewed, and the feature should be removed. The final result is to remove previousBin and all_previousBin feature

def MaximumBinPcnt(df, col):

N = df.shape[0]

total = df.groupby([col])[col].count()

pcnt = total * 1.0 / N

return max(pcnt)

discrete_columns = [

'job', 'marital', 'education', 'default', 'housing', 'loan', 'contact',

'month', 'y', 'balanceBin', 'ageBin', 'quarter', 'halfyear', 'dayBin',

'durationBin', 'campaignBin', 'pdaysBin', 'previousBin', 'all_previousBin'

]

for column in discrete_columns:

print(column, ':', MaximumBinPcnt(train_set, column))

Encode data labels

label = LabelEncoder()

for dataset in [train_set]:

dataset['job_Code'] = label.fit_transform(dataset['job'])

dataset['ageBin_Code'] = label.fit_transform(dataset['ageBin'])

dataset['marital_Code'] = label.fit_transform(dataset['marital'])

dataset['education_Code'] = label.fit_transform(dataset['education'])

dataset['default_Code'] = label.fit_transform(dataset['default'])

dataset['balanceBin_Code'] = label.fit_transform(dataset['balanceBin'])

dataset['housing_Code'] = label.fit_transform(dataset['housing'])

dataset['loan_Code'] = label.fit_transform(dataset['loan'])

dataset['contact_Code'] = label.fit_transform(dataset['contact'])

dataset['dayBin_Code'] = label.fit_transform(dataset['dayBin'])

dataset['month_Code'] = label.fit_transform(dataset['month'])

dataset['durationBin_Code'] = label.fit_transform(dataset['durationBin'])

dataset['campaignBin_Code'] = label.fit_transform(dataset['campaignBin'])

dataset['pdaysBin_Code'] = label.fit_transform(dataset['pdaysBin'])

dataset['quarter_Code'] = label.fit_transform(dataset['quarter'])

dataset['halfyear_Code'] = label.fit_transform(dataset['halfyear'])

Use chi square test to screen discrete variables,

for col in columns_train_data_x:

obs = pd.crosstab(train_set['y'],

train_set[col],

rownames=['y'],

colnames=[col])

chi2, p, dof, expect = chi2_contingency(obs)

print("{} Chi square test p value: {:.4f}".format(col, p))

#The P value of chi square test for all features was significantly less than 0.01, and all features were retained

columns_train_data_x = [

'job_Code', 'ageBin_Code', 'marital_Code', 'education_Code',

'default_Code', 'balanceBin_Code', 'housing_Code', 'loan_Code',

'contact_Code', 'dayBin_Code', 'month_Code', 'durationBin_Code',

'campaignBin_Code', 'pdaysBin_Code', 'quarter_Code', 'halfyear_Code'

]

Target = ['y']

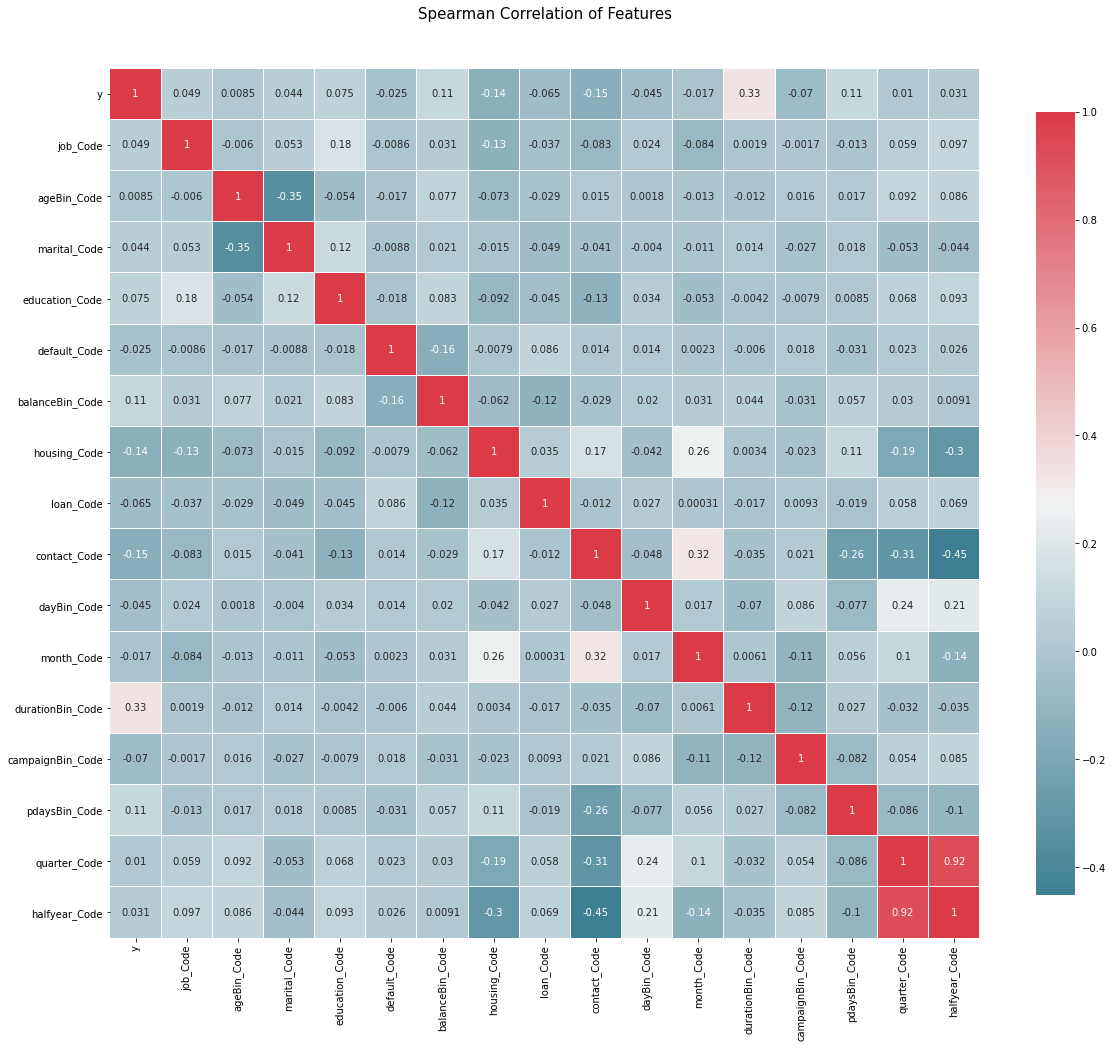

#spearman is used to test the correlation between the data

def correlation_heatmap(df):

_ , ax = plt.subplots(figsize =(20, 16))

colormap = sns.diverging_palette(220, 10, as_cmap = True)

_ = sns.heatmap(

df.corr('spearman'),

cmap = colormap,

square=True,

cbar_kws={'shrink':.9 },

ax=ax,

annot=True,

linewidths=0.1,vmax=1.0, linecolor='white',

annot_kws={'fontsize':10 }

)

plt.title('Pearson Correlation of Features', y=1.05, size=15)

correlation_heatmap(train_set[columns_train_data_xy])

quarter_Code and halfyear_Code is highly relevant, so only halfyear is selected_ Code

quarter_Code and halfyear_Code is highly relevant, so only halfyear is selected_ Code

Modeling analysis

Training data

columns_train_data_x = [

'job_Code', 'ageBin_Code', 'marital_Code', 'education_Code',

'default_Code', 'balanceBin_Code', 'housing_Code', 'loan_Code',

'contact_Code', 'dayBin_Code', 'month_Code', 'durationBin_Code',

'campaignBin_Code', 'pdaysBin_Code', 'halfyear_Code'

]

train_data_x = train_set[columns_train_data_x]

train_data_y = train_set['y']

train_data_x = pd.get_dummies(train_data_x , columns=columns_train_data_x)

The samples are up sampled by BorderlineSMOTE, ADASYN, SMOTETomek, etc

#Oversampling samples train_data_x,train_data_y = SMOTE().fit_resample(train_data_x,train_data_y) train_data_y.value_counts() #0 22356 #1 22356

GBDT

The full name of GBDT is Gradient Boosting Decision Tree, which is an integrated learning algorithm and is widely used in industry.

The grid search and optimization of GBDT can be carried out directly. If the amount of data is too large, the greedy algorithm can be used for optimization, but the greedy algorithm can only achieve local optimization.

GBDT_n_estimators = [120, 300]

GBDT_learning_rate = [0.001, 0.01]

GBDT_max_features = ['sqrt']

GBDT_max_depth = [3, 5, 8]

#GBDT_min_samples_split = [1, 2, 5, 10, 15, 100]

#GBDT_min_samples_leaf = [1, 2, 5, 10]

#GBDT_subsample = [0.5, 0.6, 0.7, 0.8, 0.9, 1]

param_grid = {

'n_estimators': GBDT_n_estimators,

'learning_rate': GBDT_learning_rate,

'max_features': GBDT_max_features,

'max_depth': GBDT_max_depth,

#'min_samples_split': GBDT_min_samples_split,

#'min_samples_leaf': GBDT_min_samples_leaf,

#'subsample': GBDT_subsample

}

cv_split = model_selection.ShuffleSplit(n_splits=10,

test_size=.3,

random_state=0)

model_tunning = GridSearchCV(ensemble.GradientBoostingClassifier(),

param_grid=param_grid,

cv=cv_split,

scoring='roc_auc')

model_tunning.fit(train_data_x, train_data_y)

print('Optimal score', model_tunning.best_score_) #Model maximum score

print('Optimal parameters', model_tunning.best_params_) #Optimal parameters

print('Optimal model', model_tunning.best_estimator_) #Optimal model

best_model = model_tunning.best_estimator_

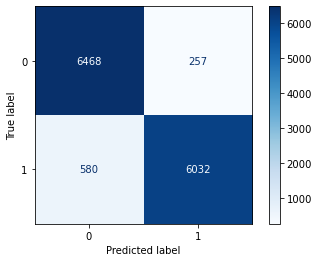

Model evaluation methods include confusion matrix, accuracy rate, recall rate, ROC curve, ACU value, etc

#Confusion matrix

x_train, x_test, y_train, y_test = model_selection.train_test_split(

train_data_x, train_data_y, train_size=.7)

model = ensemble.GradientBoostingClassifier(n_estimators=300,

learning_rate=0.1,

max_features='sqrt',

max_depth=7,

min_samples_split=500,

min_samples_leaf=60,

subsample=1)

model.fit(x_train, y_train)

y_predict = model.predict(x_test)

cm = confusion_matrix(y_test, y_predict)

ConfusionMatrixDisplay(cm).plot(cmap='Blues')

from sklearn.metrics import accuracy_score, precision_score,recall_score

print(accuracy_score(y_test, y_predict)) #Accuracy

print(precision_score(y_test, y_predict, average='weighted')) #Weighted accuracy

print(recall_score(y_test, y_predict)) #recall

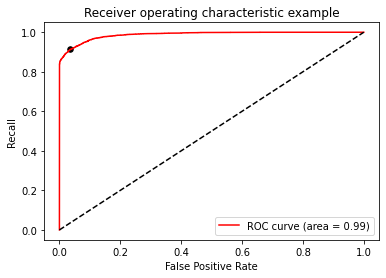

K-fold cross validation, ROC was used as the evaluation method_ auc

score = cross_val_score(model, train_data_x, train_data_y, cv=5, n_jobs=1, scoring='roc_auc') score.mean() #Final model score 0.9830339716115262

ROC curve

#ROC/AUC

model.fit(x_train, y_train)

def get_rocauc(y,X,clf):

FPR,recall,thresholds=roc_curve(y,clf.predict_proba(X)[:,1],pos_label=1)

area=roc_auc_score(y,clf.predict_proba(X)[:,1])

maxindex=(recall-FPR).tolist().index(max(recall-FPR))

threshold=thresholds[maxindex]

plt.figure()

plt.plot(FPR,recall,color='red',label='ROC curve (area = %0.2f)'%area)

plt.plot([0,1],[0,1],color='black',linestyle='--')

plt.scatter(FPR[maxindex],recall[maxindex],c='black',s=30)

plt.xlim([-0.05,1.05])

plt.ylim([-0.05,1.05])

plt.xlabel('False Positive Rate')

plt.ylabel('Recall')

plt.title('Receiver operating characteristic example')

plt.legend(loc='lower right')

plt.show()

return threshold

threshold=get_rocauc(y_test, x_test,model)

You are welcome to communicate and criticize