Note: the tutorial content is from https://nbviewer.jupyter.org/github/twiecki/financial-analysis-python-tutorial/tree/master/ This is not a complete system pandas tutorial. The test demo of this foreign tutorial is old, and the new version of pandas may not be compatible with the source program. This tutorial is a correction based on the original tutorial Test with Spyder IDE

# -*- coding: utf-8 -*-

"""

Created on Sun Mar 29 17:58:13 2020

@author: CHERN

"""

import datetime

import pandas as pd

from pandas import Series, DataFrame

print(pd.__version__)

import matplotlib.pyplot as plt

import matplotlib as mpl

mpl.rc('figure', figsize=(8, 7))

print(mpl.__version__)

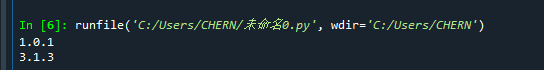

The test program uses pandas version 1.0.1 and Matplotlib version 3.1.3

1. Create and load data

1.1 generated according to python built-in list/dict

# -*- coding: utf-8 -*-

"""

Created on Sun Mar 29 17:58:13 2020

@author: CHERN

"""

import datetime

import pandas as pd

from pandas import Series, DataFrame

# print(pd.__version__)

import matplotlib.pyplot as plt

import matplotlib as mpl

mpl.rc('figure', figsize=(8, 7))

# print(mpl.__version__)

# Constructing one-dimensional sequence through python

labels = ['a', 'b', 'c', 'd', 'e']

s = Series([1, 2, 3, 4, 5], index=labels)

print(s)

print(r"'b' in s?")

print('b' in s)

print(s['b'])

print("Series.to_dict() can convert Series to dict")

mapping = s.to_dict()

print(mapping)

print("Series(dict) can convert dict to Series")

print(Series(mapping))

[the external chain image transfer fails. The source station may have an anti-theft chain mechanism. It is recommended to save the image and upload it directly (img-eKV3iS94-1586606244035)(assets/2020-03-29-18-12-01.png)]

Usage Summary

- The constructor of Series object can pass dict dictionary type variable or use list in python

- Series. to_ The dict () method can convert series objects into python built-in dict objects

- Through 'b' in s, you can judge whether the key 'b' exists in the index of the Series object, and the return value is True/False

- s['b '] can obtain data in Series

1.2 get from the network

# -*- coding: utf-8 -*-

"""

Created on Sun Mar 29 17:58:13 2020

@author: CHERN

"""

import datetime

import pandas as pd

from pandas import Series, DataFrame

# print(pd.__version__)

import numpy as np

from pandas_datareader import data, wb # PIP install pandas needs to be installed_ datareader

import matplotlib.pyplot as plt

import matplotlib

import matplotlib as mpl

mpl.rc('figure', figsize=(8, 7))

# print(mpl.__version__)

# Define the time period for obtaining data

start = datetime.datetime(2010, 1, 1)

end = datetime.datetime(2016,5,20)

sh = data.DataReader("000001.SS", 'yahoo', start, end)

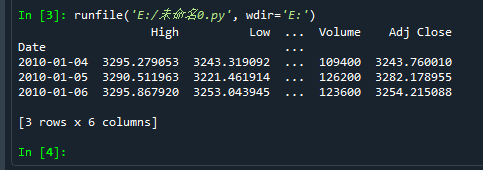

print(sh.head(3)) # First three lines of output data

# Pandas will be obtained from Yahoo Save dataframe data to csv file

sh.to_csv('sh.csv')

be careful:

- Version updated, previous PD io. data. get_ data_ Yahoo () method has been deprecated. DataReader method is currently used for experimental operation

- Domestic data access may be slow, so VPN needs to be enabled For the sake of simplicity (the code is reused directly without other files), the following case will be carried out according to the data obtained from the Internet

Usage Summary:

- from pandas_ After datareader imports data, data The datareader () method can obtain financial data (stock history data) from the network

- DataFrame object can be used if there are too many rows The head() method outputs its first five lines head(n) output the first n lines

Note: here, Date is the index of the object sh

1.3 read data from file (. CSV /. Xlsx, etc.)

# -*- coding: utf-8 -*-

"""

Created on Sun Mar 29 17:58:13 2020

@author: CHERN

"""

import datetime

import pandas as pd

from pandas import Series, DataFrame

# print(pd.__version__)

import numpy as np

from pandas_datareader import data, wb # PIP install pandas needs to be installed_ datareader

import matplotlib.pyplot as plt

import matplotlib

import matplotlib as mpl

mpl.rc('figure', figsize=(8, 7))

# print(mpl.__version__)

# Define the time period for obtaining data

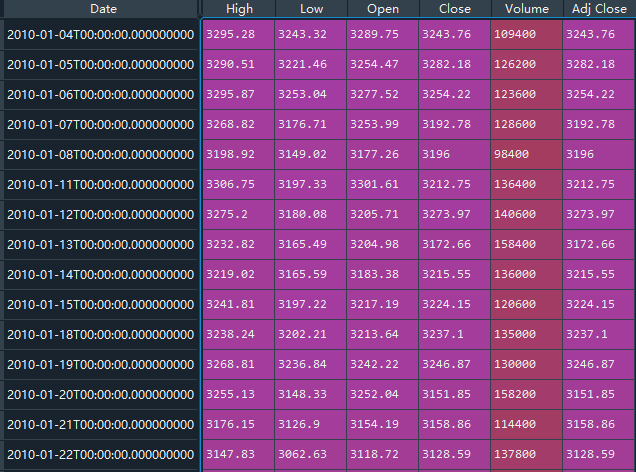

df = pd.read_csv('sh.csv', index_col='Date', parse_dates=True)

print(df)

2. Series and DataFrame: (basic operation)

2.1 index slice create new column

# -*- coding: utf-8 -*-

"""

Created on Sun Mar 29 17:58:13 2020

@author: CHERN

"""

import datetime

import pandas as pd

from pandas import Series, DataFrame

# print(pd.__version__)

import numpy as np

from pandas_datareader import data, wb # PIP install pandas needs to be installed_ datareader

import matplotlib.pyplot as plt

import matplotlib

import matplotlib as mpl

mpl.rc('figure', figsize=(8, 7))

# print(mpl.__version__)

# Define the time period for obtaining data

df = pd.read_csv('sh.csv', index_col='Date', parse_dates=True)

# print(df)

# type(ts) = pandas.core.series.Series

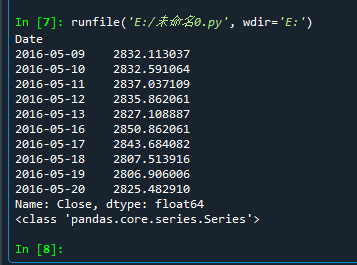

ts = df['Close'][-10:]

print(ts)

print(type(ts))

Continue in IPython:

date = ts.index[5] date

Output:

Timestamp('2016-05-16 00:00:00')

Input:

ts[date]

Output:

2850.862060546875

Input:

ts[5]

Output:

2850.862060546875

Input:

df[['Open', 'Close']].head()

Output:

Open Close Date 2010-01-04 3289.750000 3243.760010 2010-01-05 3254.468018 3282.178955 2010-01-06 3277.517090 3254.215088 2010-01-07 3253.990967 3192.775879 2010-01-08 3177.259033 3195.997070

Input:

df['diff'] = df.Open - df.Close df.head()

Output:

High Low ... Adj Close diff Date ... 2010-01-04 3295.279053 3243.319092 ... 3243.760010 45.989990 2010-01-05 3290.511963 3221.461914 ... 3282.178955 -27.710938 2010-01-06 3295.867920 3253.043945 ... 3254.215088 23.302002 2010-01-07 3268.819092 3176.707031 ... 3192.775879 61.215088 2010-01-08 3198.919922 3149.017090 ... 3195.997070 -18.738037 [5 rows x 7 columns]

Input:

del df['diff'] df.head()

Output:

High Low ... Volume Adj Close Date ... 2010-01-04 3295.279053 3243.319092 ... 109400 3243.760010 2010-01-05 3290.511963 3221.461914 ... 126200 3282.178955 2010-01-06 3295.867920 3253.043945 ... 123600 3254.215088 2010-01-07 3268.819092 3176.707031 ... 128600 3192.775879 2010-01-08 3198.919922 3149.017090 ... 98400 3195.997070 [5 rows x 6 columns]

Usage Summary:

- The instruction del df['diff'] can delete the 'diff' column in the data df

3. Conventional financial calculation

3.1 moving average

close_px = df['Adj Close'] mavg = pd.rolling_mean(close_px, 40) mavg[-10:]

Output:

File "<ipython-input-14-9dd3f0f7e3fa>", line 2, in <module>

mavg = pd.rolling_mean(close_px, 40)

File "C:\Python\lib\site-packages\pandas\__init__.py", line 262, in __getattr__

raise AttributeError(f"module 'pandas' has no attribute '{name}'")

AttributeError: module 'pandas' has no attribute 'rolling_mean'

pandas version update, enabling rolling_ Method () mean

close_px = df['Adj Close'] mavg = close_px.rolling(40).mean() mavg

Output:

Date

2010-01-04 NaN

2010-01-05 NaN

2010-01-06 NaN

2010-01-07 NaN

2010-01-08 NaN

2016-05-16 2970.439978

2016-05-17 2967.653333

2016-05-18 2962.371130

2016-05-19 2957.559705

2016-05-20 2952.947778

Name: Adj Close, Length: 1550, dtype: float64

3.2 revenue

Input:

rets = close_px / close_px.shift(1) - 1 # rets = close_px.pct_change() rets.head()

Output:

Date 2010-01-04 NaN 2010-01-05 0.011844 2010-01-06 -0.008520 2010-01-07 -0.018880 2010-01-08 0.001009 Name: Adj Close, dtype: float64

4. Drawing basis

close_px.plot(label='AAPL') mavg.plot(label='mavg') plt.legend()

[the external chain picture transfer fails. The source station may have an anti-theft chain mechanism. It is recommended to save the picture and upload it directly (img-VS5moCnW-1586606244038)(assets/2020-03-29-20-40-41.png)]

Extend

# -*- coding: utf-8 -*-

"""

Created on Sun Mar 29 17:58:13 2020

@author: CHERN

"""

import datetime

import pandas as pd

from pandas import Series, DataFrame

# print(pd.__version__)

import numpy as np

from pandas_datareader import data, wb # PIP install pandas needs to be installed_ datareader

import matplotlib.pyplot as plt

import matplotlib

import matplotlib as mpl

mpl.rc('figure', figsize=(8, 7))

# print(mpl.__version__)

# Define the time period for obtaining data

start = datetime.datetime(2010, 1, 1)

end = datetime.datetime(2016,5,20)

sh = data.DataReader(['AAPL','GE','GOOG','IBM','KO', 'MSFT', 'PEP'],'yahoo', start, end)['Adj Close']

print(sh.head(3)) # First three lines of output data

Symbols AAPL GE GOOG ... KO MSFT PEP Date ... 2009-12-31 26.131752 10.526512 308.832428 ... 19.278732 23.925440 44.622261 2010-01-04 26.538483 10.749147 312.204773 ... 19.292267 24.294369 44.945187 2010-01-05 26.584366 10.804806 310.829926 ... 19.058893 24.302216 45.488274 [3 rows x 7 columns]

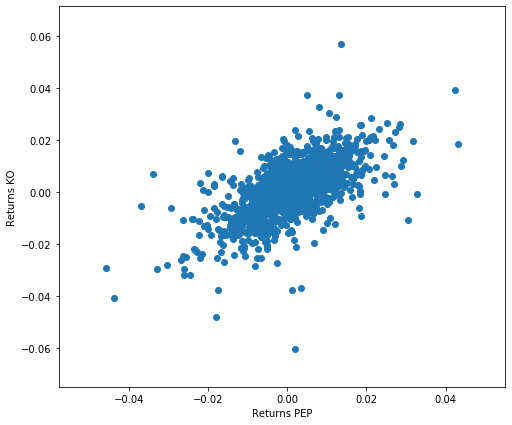

Input:

rets = df.pct_change()

plt.scatter(rets.PEP, rets.KO)

plt.xlabel('Returns PEP')

plt.ylabel('Returns KO')

pd.scatter_matrix(rets, diagonal='kde', figsize=(10, 10));

Output:

File "C:\Python\lib\site-packages\pandas\__init__.py", line 262, in __getattr__

raise AttributeError(f"module 'pandas' has no attribute '{name}'")

AttributeError: module 'pandas' has no attribute 'scatter_matrix'

Scatter of pandas_ Matrix usage has changed to pandas plotting. scatter_matrix

Re-enter:

pd.plotting.scatter_matrix(rets, diagonal='kde', figsize=(10, 10));

[the external chain image transfer fails. The source station may have an anti-theft chain mechanism. It is recommended to save the image and upload it directly (img-aAdqCmPm-1586606244040)(assets/2020-03-29-21-18-44.png)]

Knowledge summary:

- Scatter chart is a tool used to judge the relationship between two variables. Generally, scatter chart uses two groups of data to form multiple coordinate points. By observing the distribution of coordinate points, it can judge whether there is a correlation relationship between variables and the strength of the correlation relationship. In addition, if there is no correlation, the scatter diagram can be used to summarize the distribution pattern of feature points, i.e. matrix diagram (quadrant diagram)

- pd.scatter_matrix() and PD Scatter() is used to draw scatter matrix and scatter chart

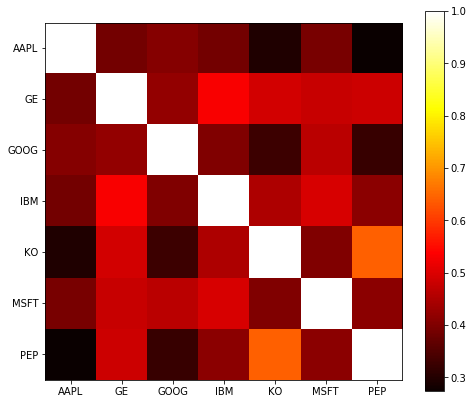

Input:

corr = rets.corr() corr

Output:

Symbols AAPL GE GOOG IBM KO MSFT PEP Symbols AAPL 1.000000 0.387574 0.406971 0.387261 0.298461 0.393892 0.273217 GE 0.387574 1.000000 0.423675 0.532942 0.491217 0.478202 0.485198 GOOG 0.406971 0.423675 1.000000 0.402424 0.329096 0.463922 0.322701 IBM 0.387261 0.532942 0.402424 1.000000 0.449300 0.495341 0.412432 KO 0.298461 0.491217 0.329096 0.449300 1.000000 0.402174 0.643624 MSFT 0.393892 0.478202 0.463922 0.495341 0.402174 1.000000 0.414073 PEP 0.273217 0.485198 0.322701 0.412432 0.643624 0.414073 1.000000

Input:

plt.imshow(corr, cmap='hot', interpolation='none') plt.colorbar() plt.xticks(range(len(corr)), corr.columns) plt.yticks(range(len(corr)), corr.columns);

Usage Summary:

- pd. The corr () method is used to calculate the correlation between two sequences

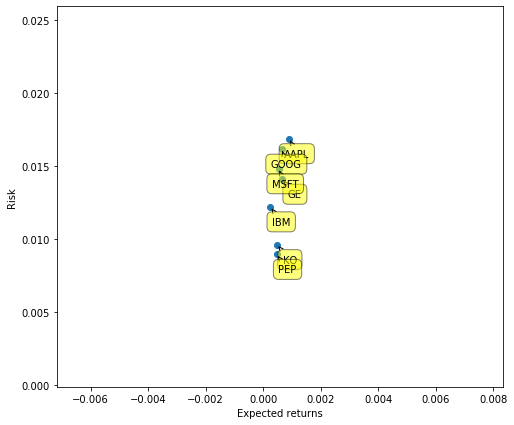

One thing we are often interested in is the relationship between the expected return (usually the mean of the rate of return) and the risk we take (the variance of the rate of return). There is often a trade-off between the two.

Here we use PLT Annotate labels the scatter chart.

plt.scatter(rets.mean(), rets.std())

plt.xlabel('Expected returns')

plt.ylabel('Risk')

for label, x, y in zip(rets.columns, rets.mean(), rets.std()):

plt.annotate(

label,

xy = (x, y), xytext = (20, -20),

textcoords = 'offset points', ha = 'right', va = 'bottom',

bbox = dict(boxstyle = 'round,pad=0.5', fc = 'yellow', alpha = 0.5),

arrowprops = dict(arrowstyle = '->', connectionstyle = 'arc3,rad=0'))

5. Data alignment and Nan processing

Procedure:

# -*- coding: utf-8 -*-

"""

Created on Sun Mar 29 17:58:13 2020

@author: CHERN

"""

import datetime

import pandas as pd

from pandas import Series, DataFrame

# print(pd.__version__)

import numpy as np

from pandas_datareader import data, wb # PIP install pandas needs to be installed_ datareader

import matplotlib.pyplot as plt

import matplotlib

import matplotlib as mpl

mpl.rc('figure', figsize=(8, 7))

# print(mpl.__version__)

series_list = []

securities = ['AAPL', 'GOOG', 'IBM', 'MSFT']

for security in securities:

s = data.DataReader(security,'yahoo',

start=datetime.datetime(2011, 10, 1),

end=datetime.datetime(2013, 1, 1))['Adj Close']

s.name = security # Rename series to match security name

series_list.append(s)

df = pd.concat(series_list, axis=1)

print(df.head())

AAPL GOOG IBM MSFT Date 2011-09-30 47.285904 256.558350 130.822800 20.321293 2011-10-03 46.452591 246.834808 129.640747 20.027370 2011-10-04 46.192177 250.012894 130.725555 20.688694 2011-10-05 46.905209 251.407669 132.304108 21.137737 2011-10-06 46.796078 256.393982 135.924973 21.505136

Input:

df.ix[0, 'AAPL'] = np.nan df.ix[1, ['GOOG', 'IBM']] = np.nan df.ix[[1, 2, 3], 'MSFT'] = np.nan df.head()

Output:

AttributeError: 'DataFrame' object has no attribute 'ix'

Input:

df.loc[df.index[0],['AAPL']] = np.nan df.loc[df.index[1],['GOOG','IBM']]=np.nan df.loc[df.index[1:3],'MSFT']=np.nan

Output:

AAPL GOOG IBM MSFT Date 2011-09-30 NaN 256.558350 130.822800 20.321293 2011-10-03 46.452591 NaN NaN NaN 2011-10-04 46.192177 250.012894 130.725555 NaN 2011-10-05 46.905209 251.407669 132.304108 NaN 2011-10-06 46.796078 256.393982 135.924973 21.505136

Input:

(df.AAPL + df.GOOG).head()

Output:

Date 2011-09-30 NaN 2011-10-03 NaN 2011-10-04 296.205070 2011-10-05 298.312878 2011-10-06 303.190060 dtype: float64

Input:

df.ffill().head()

Output:

AAPL GOOG IBM MSFT Date 2011-09-30 NaN 256.558350 130.822800 20.321293 2011-10-03 46.452591 256.558350 130.822800 20.321293 2011-10-04 46.192177 250.012894 130.725555 20.321293 2011-10-05 46.905209 251.407669 132.304108 20.321293 2011-10-06 46.796078 256.393982 135.924973 21.505136

NaN

2011-10-04 296.205070

2011-10-05 298.312878

2011-10-06 303.190060

dtype: float64

Input: ```python df.ffill().head()

Output:

AAPL GOOG IBM MSFT Date 2011-09-30 NaN 256.558350 130.822800 20.321293 2011-10-03 46.452591 256.558350 130.822800 20.321293 2011-10-04 46.192177 250.012894 130.725555 20.321293 2011-10-05 46.905209 251.407669 132.304108 20.321293 2011-10-06 46.796078 256.393982 135.924973 21.505136