Time series analysis

ARIMA

Stationarity: stationarity requires that the fitting curve obtained through the sample time series can continue along the existing form "inertia" in the future

Stationarity requires that the mean and variance of the series do not change significantly

Strict and weak stability:

Yan pingwen: the distribution represented by Yan pingwen does not change with time. For example: white noise (normal), no matter how it is taken, the expectation is 0 and the variance is 1

Weak stationarity: the expectation and correlation coefficient (dependence) remain unchanged. The value Xt of t at a certain time in the future depends on its past information, so dependence is required

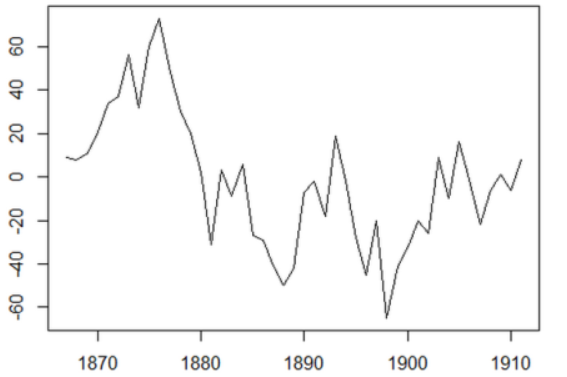

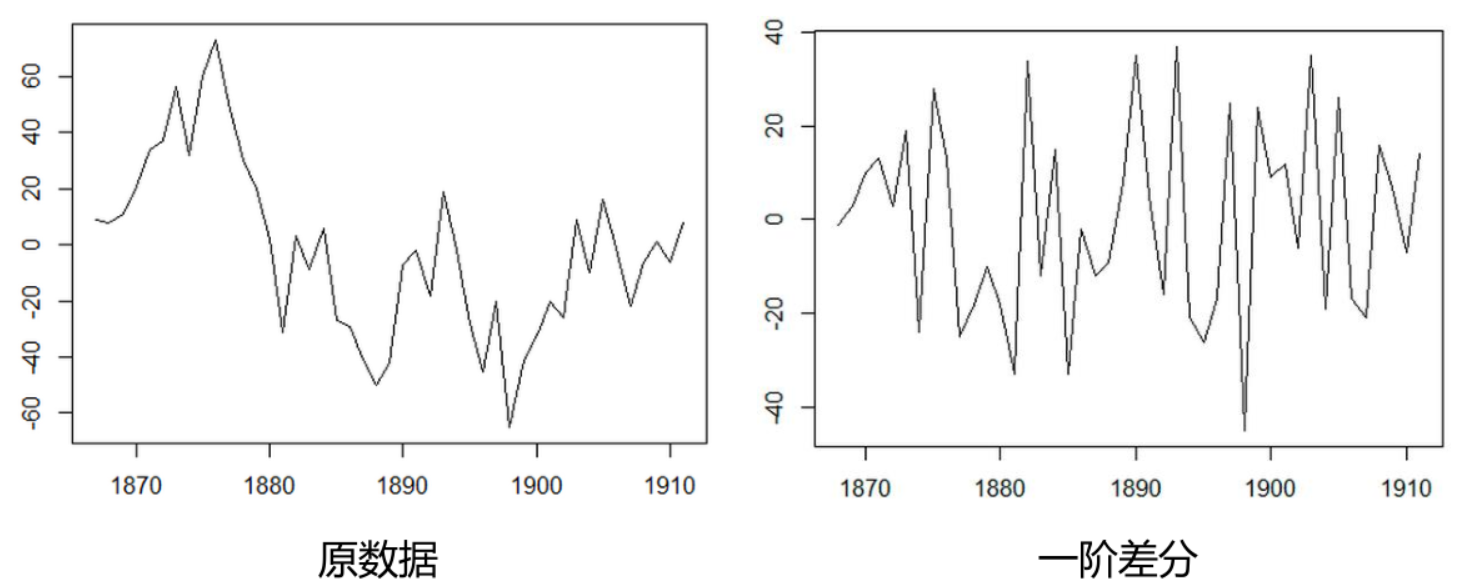

Difference method: the difference between time series at time t and time t-1

Autoregressive model (AR)

Describe the relationship between the current value and the historical value, and use the historical time data of the variable to predict itself

The autoregressive model must meet the requirements of stationarity

Formula definition of p-order autoregressive process:

y

t

=

μ

+

∑

i

=

1

p

γ

i

y

t

−

i

+

ϵ

t

y_{t}=\mu+\sum_{i=1}^{p} \gamma_{i} y_{t-i}+\epsilon_{t}

yt=μ+∑i=1pγiyt−i+ϵt

y

t

y_{t}

yt , is the current value

μ

\mu

μ The P-order term is a constant

γ

i

\gamma_{i}

γ i is the autocorrelation coefficient

ϵ

t

\epsilon_{t}

ϵ t is the error

Limitations of autoregressive models

Autoregressive model uses its own data to predict

It must be stable

Must have autocorrelation if autocorrelation coefficient( φ i) Less than 0.5, it should not be used

Autoregression is only applicable to predict the phenomena related to its own early stage

Moving average model (MA)

Moving average model focuses on the accumulation of error terms in autoregressive model

Formula definition of q-order autoregressive process:

y

t

=

μ

+

ϵ

t

+

∑

i

=

1

q

θ

i

ϵ

t

−

i

y_{t}=\mu+\epsilon_{t}+\sum_{i=1}^{q} \theta_{i} \epsilon_{t-i}

yt=μ+ϵt+∑i=1qθiϵt−i

The moving average method can effectively eliminate the random fluctuation in prediction

Autoregressive moving average model (ARMA)

Combination of autoregressive and moving average

Formula definition:

y

t

=

μ

+

∑

i

=

1

p

γ

i

y

t

−

i

+

ϵ

t

+

∑

i

=

1

q

θ

i

ϵ

t

−

i

y_{t}=\mu+\sum_{i=1}^{p} \gamma_{i} y_{t-i}+\epsilon_{t}+\sum_{i=1}^{q} \theta_{i} \epsilon_{t-i}

yt=μ+∑i=1pγiyt−i+ϵt+∑i=1qθiϵt−i

ARIMA(p, d, q) model

The full name is Autoregressive Integrated Moving Average Model (ARIMA)

AR is autoregressive and p is autoregressive term; MA is the moving average, q is the number of moving average items, and d is the number of differences when the time series becomes stationary

Principle: the model is established by transforming non-stationary time series into stationary time series, and then regressing the dependent variable only to its lag value and the present value and lag value of random error term

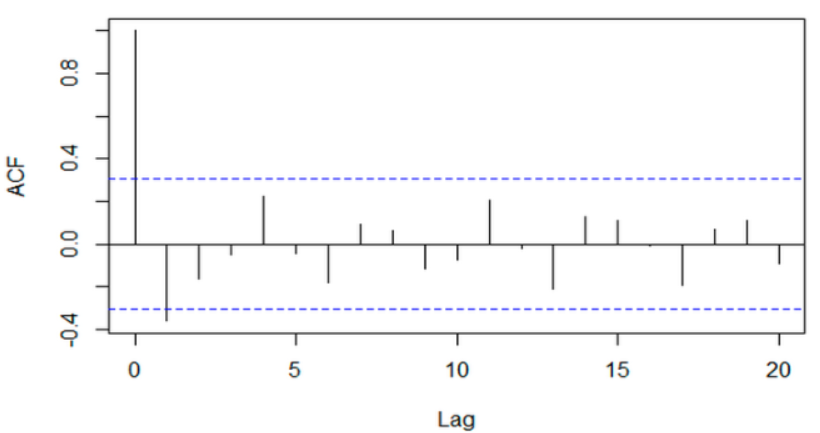

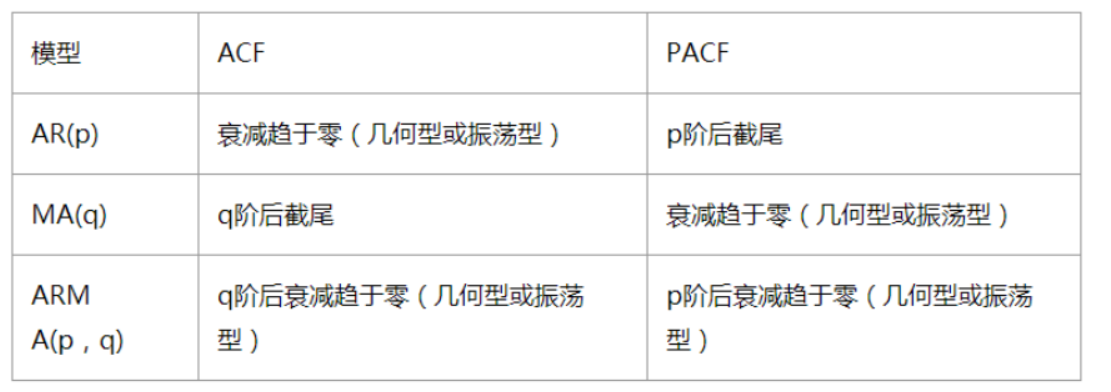

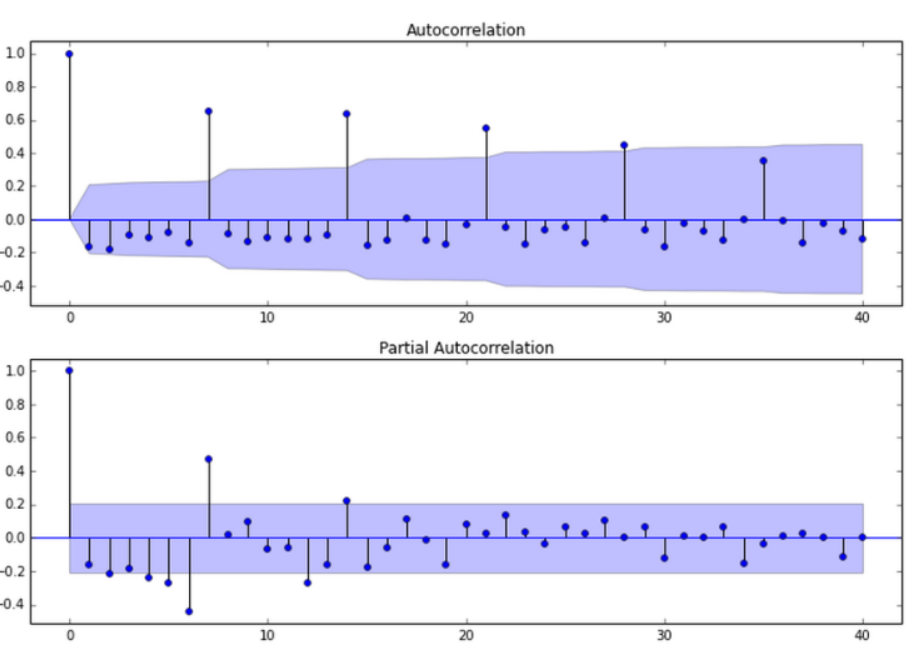

Autocorrelation function ACF(autocorrelation function)

An ordered sequence of random variables is compared with itself

Autocorrelation function reflects the correlation between the values of the same sequence in different time series

Formula:

A

C

F

(

k

)

=

ρ

k

=

Cov

(

y

t

,

y

t

−

k

)

Var

(

y

t

)

A C F(k)=\rho_{k}=\frac{\operatorname{Cov}\left(y_{t}, y_{t-k}\right)}{\operatorname{Var}\left(y_{t}\right)}

ACF(k)=ρk=Var(yt)Cov(yt,yt−k)

The value range of Pk is [- 1,1]

Partial autocorrelation function (PACF)

For a stationary AR § model, when the autocorrelation coefficient p(k) of lag K is calculated, the simple correlation between x(t) and x(t-k) is not obtained

At the same time, x(t) is also affected by the middle k-1 random variables x(t-1), x(t-2),..., x(t-k+1), and these k-1 random variables are related to x(t-k). Therefore, the autocorrelation coefficient p(k) is actually doped with the influence of other variables on x(t) and x(t-k)

After eliminating the interference of the middle k-1 random variables x(t-1), x(t-2),..., x(t-k+1), the correlation degree of the influence of x(t-k) on x(t).

ACF also includes the influence of other variables, and the partial autocorrelation coefficient PACF is the strict correlation between the two variables

Determination of ARIMA(p, d, q) Order:

Truncation: falling within the confidence interval (95% of the points comply with the rule)

AR § see PACF; MA(q) looking at ACF

ARIMA modeling process:

Stabilize the sequence (determined by difference method d); Determination of order P and Q: ACF and PACF; ARIMA(p,d,q)

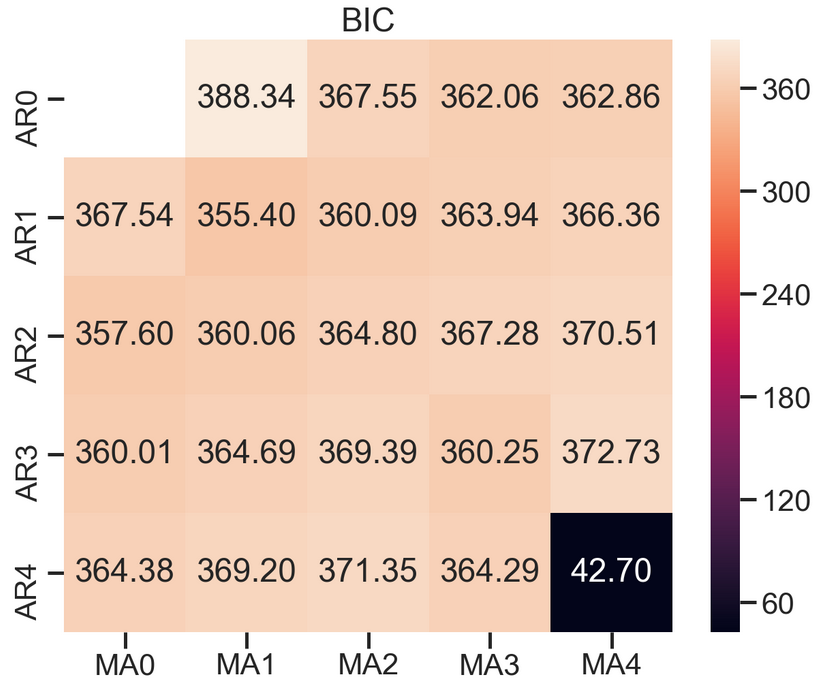

Model selection AIC and BIC: choose a simpler model

AIC: Akaike Information Criterion (AIC)

A

I

C

=

2

k

−

2

ln

(

L

)

A I C=2 k-2 \ln (L)

AIC=2k−2ln(L)

BIC: Bayesian Information Criterion (BIC)

B

I

C

=

k

ln

(

n

)

−

2

ln

(

L

)

B I C=k \ln (n)-2 \ln (L)

BIC=kln(n)−2ln(L)

k is the number of model parameters, n is the number of samples, and L is the likelihood function

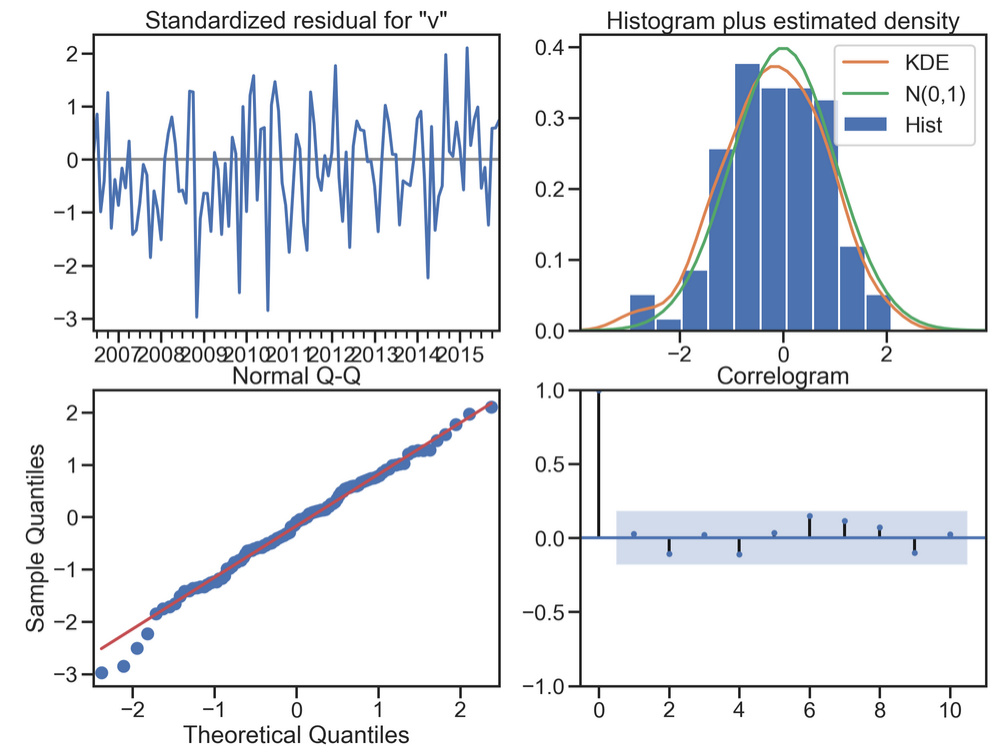

Model residual test: whether the residual of ARIMA model is a normal distribution with an average value of 0 and a constant variance

QQ chart: linear or normal distribution

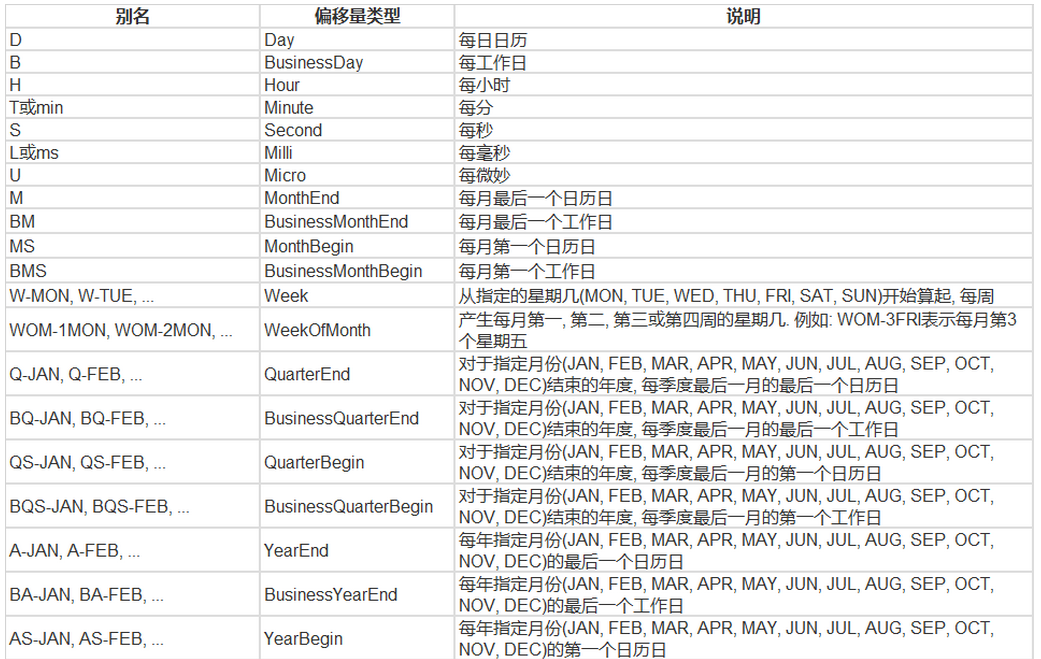

Pandas generate time series

Dates & Times

import pandas as pd import numpy as np

time series

- timestamp

- Fixed period

- Time interval

date_range

- You can specify the start time and period

- H: Hours

- D: Oh, my God

- M: Month

# TIMES

#2016 Jul 1; 7/1/2016; 1/7/2016; 2016-07-01; 2016/07/01

# freq refers to frequency, '3D' refers to 3 days

rng = pd.date_range('2016-07-01', periods = 10, freq = '3D')

rng

DatetimeIndex(['2016-07-01', '2016-07-04', '2016-07-07', '2016-07-10',

'2016-07-13', '2016-07-16', '2016-07-19', '2016-07-22',

'2016-07-25', '2016-07-28'],

dtype='datetime64[ns]', freq='3D')

import datetime as dt

time=pd.Series(np.random.randn(20),

index=pd.date_range(dt.datetime(2016,1,1),periods=20))

print(time)

2016-01-01 -0.188009

2016-01-02 -0.368154

2016-01-03 0.192915

2016-01-04 -1.000698

2016-01-05 -0.324694

2016-01-06 0.570503

2016-01-07 0.014892

2016-01-08 1.441954

2016-01-09 0.768429

2016-01-10 -0.421610

2016-01-11 -0.056000

2016-01-12 0.480678

2016-01-13 1.551418

2016-01-14 0.054797

2016-01-15 0.505593

2016-01-16 -1.217634

2016-01-17 -0.243987

2016-01-18 -1.120619

2016-01-19 -0.492803

2016-01-20 -0.506725

Freq: D, dtype: float64

truncate filtering

time.truncate(before='2016-1-10')

2016-01-10 -0.421610

2016-01-11 -0.056000

2016-01-12 0.480678

2016-01-13 1.551418

2016-01-14 0.054797

2016-01-15 0.505593

2016-01-16 -1.217634

2016-01-17 -0.243987

2016-01-18 -1.120619

2016-01-19 -0.492803

2016-01-20 -0.506725

Freq: D, dtype: float64

time.truncate(after='2016-1-10')

2016-01-01 -0.188009

2016-01-02 -0.368154

2016-01-03 0.192915

2016-01-04 -1.000698

2016-01-05 -0.324694

2016-01-06 0.570503

2016-01-07 0.014892

2016-01-08 1.441954

2016-01-09 0.768429

2016-01-10 -0.421610

Freq: D, dtype: float64

print(time['2016-01-15'])

0.5055933447272851

print(time['2016-01-15':'2016-01-20'])

2016-01-15 0.505593

2016-01-16 -1.217634

2016-01-17 -0.243987

2016-01-18 -1.120619

2016-01-19 -0.492803

2016-01-20 -0.506725

Freq: D, dtype: float64

data=pd.date_range('2010-01-01','2011-01-01',freq='M')

print(data)

DatetimeIndex(['2010-01-31', '2010-02-28', '2010-03-31', '2010-04-30',

'2010-05-31', '2010-06-30', '2010-07-31', '2010-08-31',

'2010-09-30', '2010-10-31', '2010-11-30', '2010-12-31'],

dtype='datetime64[ns]', freq='M')

#time stamp

pd.Timestamp('2016-07-10')

Timestamp('2016-07-10 00:00:00')

# You can specify more details

pd.Timestamp('2016-07-10 10')

Timestamp('2016-07-10 10:00:00')

pd.Timestamp('2016-07-10 10:15')

Timestamp('2016-07-10 10:15:00')

t = pd.Timestamp('2016-07-10 10:15')

# Time interval

pd.Period('2016-01')

Period('2016-01', 'M')

pd.Period('2016-01-01')

Period('2016-01-01', 'D')

# TIME OFFSETS

# Time addition and subtraction

pd.Timedelta('1 day')

Timedelta('1 days 00:00:00')

pd.Period('2016-01-01 10:10') + pd.Timedelta('1 day')

Period('2016-01-02 10:10', 'T')

pd.Timestamp('2016-01-01 10:10') + pd.Timedelta('1 day')

Timestamp('2016-01-02 10:10:00')

pd.Timestamp('2016-01-01 10:10') + pd.Timedelta('15 ns')

Timestamp('2016-01-01 10:10:00.000000015')

p1 = pd.period_range('2016-01-01 10:10', freq = '25H', periods = 10)

p2 = pd.period_range('2016-01-01 10:10', freq = '1D1H', periods = 10)

p1

PeriodIndex(['2016-01-01 10:00', '2016-01-02 11:00', '2016-01-03 12:00',

'2016-01-04 13:00', '2016-01-05 14:00', '2016-01-06 15:00',

'2016-01-07 16:00', '2016-01-08 17:00', '2016-01-09 18:00',

'2016-01-10 19:00'],

dtype='period[25H]')

p2

PeriodIndex(['2016-01-01 10:00', '2016-01-02 11:00', '2016-01-03 12:00',

'2016-01-04 13:00', '2016-01-05 14:00', '2016-01-06 15:00',

'2016-01-07 16:00', '2016-01-08 17:00', '2016-01-09 18:00',

'2016-01-10 19:00'],

dtype='period[25H]')

# Specify index

rng = pd.date_range('2016 Jul 1', periods = 10, freq = 'D')

rng

pd.Series(range(len(rng)), index = rng)

2016-07-01 0

2016-07-02 1

2016-07-03 2

2016-07-04 3

2016-07-05 4

2016-07-06 5

2016-07-07 6

2016-07-08 7

2016-07-09 8

2016-07-10 9

Freq: D, dtype: int64

periods = [pd.Period('2016-01'), pd.Period('2016-02'), pd.Period('2016-03')]

ts = pd.Series(np.random.randn(len(periods)), index = periods)

ts

2016-01 0.340616

2016-02 0.255040

2016-03 -1.991041

Freq: M, dtype: float64

type(ts.index)

# Timestamps and time periods can be converted

ts = pd.Series(range(10), pd.date_range('07-10-16 8:00', periods = 10, freq = 'H'))

ts

2016-07-10 08:00:00 0

2016-07-10 09:00:00 1

2016-07-10 10:00:00 2

2016-07-10 11:00:00 3

2016-07-10 12:00:00 4

2016-07-10 13:00:00 5

2016-07-10 14:00:00 6

2016-07-10 15:00:00 7

2016-07-10 16:00:00 8

2016-07-10 17:00:00 9

Freq: H, dtype: int64

ts_period = ts.to_period() ts_period

2016-07-10 08:00 0

2016-07-10 09:00 1

2016-07-10 10:00 2

2016-07-10 11:00 3

2016-07-10 12:00 4

2016-07-10 13:00 5

2016-07-10 14:00 6

2016-07-10 15:00 7

2016-07-10 16:00 8

2016-07-10 17:00 9

Freq: H, dtype: int64

ts_period['2016-07-10 08:30':'2016-07-10 11:45']

2016-07-10 08:00 0

2016-07-10 09:00 1

2016-07-10 10:00 2

2016-07-10 11:00 3

Freq: H, dtype: int64

ts['2016-07-10 08:30':'2016-07-10 11:45']

2016-07-10 09:00:00 1

2016-07-10 10:00:00 2

2016-07-10 11:00:00 3

Freq: H, dtype: int64

Pandas data resampling

import pandas as pd import numpy as np

Data resampling

- Time data is converted from one frequency to another

- Downsampling

- Liter sampling

rng = pd.date_range('1/1/2011', periods=90, freq='D')

ts = pd.Series(np.random.randn(len(rng)), index=rng)

ts.head()

2011-01-01 1.325061

2011-01-02 -0.007781

2011-01-03 -0.574297

2011-01-04 1.179030

2011-01-05 -1.892891

Freq: D, dtype: float64

ts.resample('M').sum()

2011-01-31 7.061535

2011-02-28 -1.360312

2011-03-31 -4.334479

Freq: M, dtype: float64

ts.resample('3D').sum()

2011-01-01 0.742984

2011-01-04 1.168289

2011-01-07 -2.558146

2011-01-10 -0.596113

2011-01-13 -0.822468

2011-01-16 1.264703

2011-01-19 3.908058

2011-01-22 2.020699

2011-01-25 1.829759

2011-01-28 -0.606650

2011-01-31 1.142033

2011-02-03 1.605801

2011-02-06 -2.059437

2011-02-09 -0.432942

2011-02-12 0.403229

2011-02-15 2.503971

2011-02-18 1.992525

2011-02-21 -1.553652

2011-02-24 -1.669596

2011-02-27 -1.248293

2011-03-02 -5.028106

2011-03-05 -0.501333

2011-03-08 0.694710

2011-03-11 -1.223193

2011-03-14 -1.395738

2011-03-17 -0.689522

2011-03-20 2.783964

2011-03-23 0.465247

2011-03-26 -0.812388

2011-03-29 0.038350

Freq: 3D, dtype: float64

day3Ts = ts.resample('3D').mean()

day3Ts

2011-01-01 0.247661

2011-01-04 0.389430

2011-01-07 -0.852715

2011-01-10 -0.198704

2011-01-13 -0.274156

2011-01-16 0.421568

2011-01-19 1.302686

2011-01-22 0.673566

2011-01-25 0.609920

2011-01-28 -0.202217

2011-01-31 0.380678

2011-02-03 0.535267

2011-02-06 -0.686479

2011-02-09 -0.144314

2011-02-12 0.134410

2011-02-15 0.834657

2011-02-18 0.664175

2011-02-21 -0.517884

2011-02-24 -0.556532

2011-02-27 -0.416098

2011-03-02 -1.676035

2011-03-05 -0.167111

2011-03-08 0.231570

2011-03-11 -0.407731

2011-03-14 -0.465246

2011-03-17 -0.229841

2011-03-20 0.927988

2011-03-23 0.155082

2011-03-26 -0.270796

2011-03-29 0.012783

Freq: 3D, dtype: float64

print(day3Ts.resample('D').asfreq())

2011-01-01 0.247661

2011-01-02 NaN

2011-01-03 NaN

2011-01-04 0.389430

2011-01-05 NaN

...

2011-03-25 NaN

2011-03-26 -0.270796

2011-03-27 NaN

2011-03-28 NaN

2011-03-29 0.012783

Freq: D, Length: 88, dtype: float64

Interpolation method:

- Fill null value takes the previous value

- bfill null value takes the following value

- interpolate linear value

day3Ts.resample('D').ffill(1)

2011-01-01 0.247661

2011-01-02 0.247661

2011-01-03 NaN

2011-01-04 0.389430

2011-01-05 0.389430

...

2011-03-25 NaN

2011-03-26 -0.270796

2011-03-27 -0.270796

2011-03-28 NaN

2011-03-29 0.012783

Freq: D, Length: 88, dtype: float64

day3Ts.resample('D').bfill(1)

2011-01-01 0.247661

2011-01-02 NaN

2011-01-03 0.389430

2011-01-04 0.389430

2011-01-05 NaN

...

2011-03-25 -0.270796

2011-03-26 -0.270796

2011-03-27 NaN

2011-03-28 0.012783

2011-03-29 0.012783

Freq: D, Length: 88, dtype: float64

day3Ts.resample('D').interpolate('linear')

2011-01-01 0.247661

2011-01-02 0.294917

2011-01-03 0.342174

2011-01-04 0.389430

2011-01-05 -0.024619

...

2011-03-25 -0.128836

2011-03-26 -0.270796

2011-03-27 -0.176269

2011-03-28 -0.081743

2011-03-29 0.012783

Freq: D, Length: 88, dtype: float64

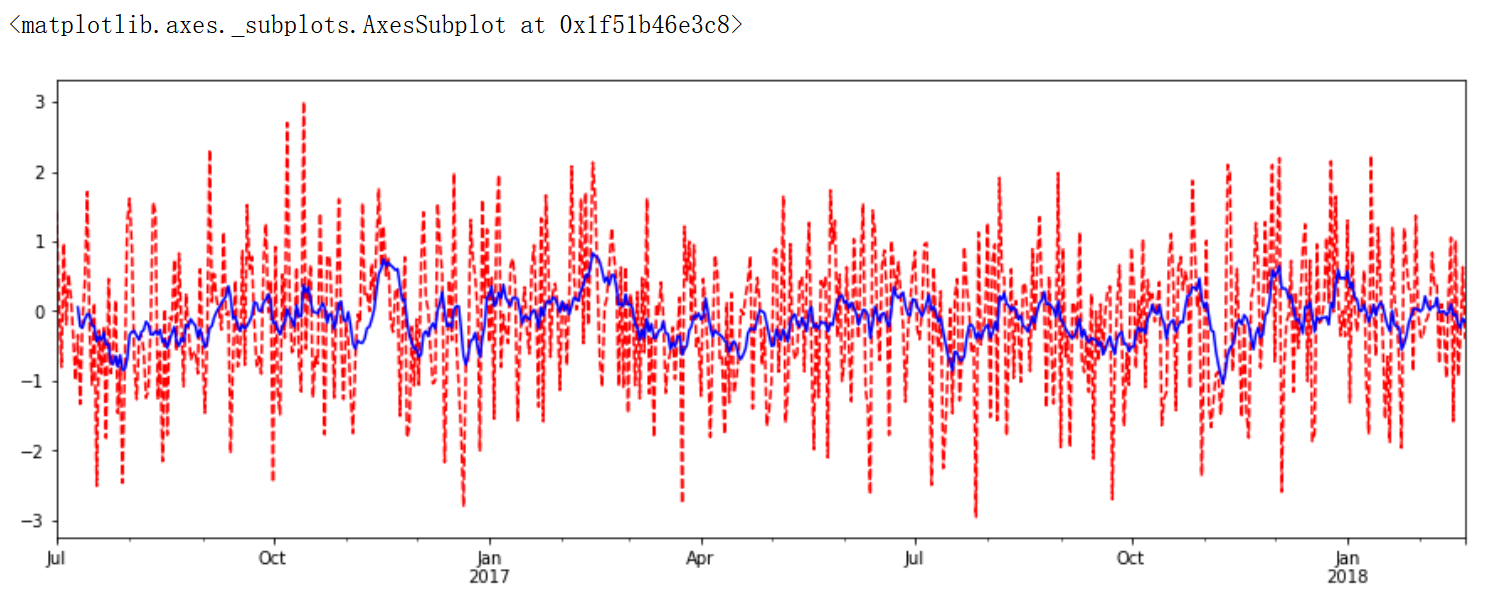

Pandas sliding window

%matplotlib inline import matplotlib.pylab import numpy as np import pandas as pd

df = pd.Series(np.random.randn(600), index = pd.date_range('7/1/2016', freq = 'D', periods = 600))

df.head()

2016-07-01 1.427084

2016-07-02 0.074392

2016-07-03 -0.806538

2016-07-04 0.973909

2016-07-05 -0.196484

Freq: D, dtype: float64

r = df.rolling(window = 10) r

Rolling [window=10,center=False,axis=0,method=single]

#r.max, r.median, r.std, r.skew, r.sum, r.var print(r.mean())

2016-07-01 NaN

2016-07-02 NaN

2016-07-03 NaN

2016-07-04 NaN

2016-07-05 NaN

...

2018-02-16 -0.044556

2018-02-17 -0.172443

2018-02-18 -0.247636

2018-02-19 -0.109076

2018-02-20 -0.159144

Freq: D, Length: 600, dtype: float64

import matplotlib.pyplot as plt %matplotlib inline plt.figure(figsize=(15, 5)) df.plot(style='r--') df.rolling(window=10).mean().plot(style='b')

ARIMA model example

Download statsmodels Library

If you directly pip, it will be very slow and the network is easy to break, which is very annoying. It is suggested to go to this website: https://www.lfd.uci.edu/ ~Gohlke / Python LIBS /, Search Stats models, download the corresponding version, and then download the library from the local pip, but it's still a little slow.

Establish ARIMA model

# http://www.lfd.uci.edu/~gohlke/pythonlibs / Library Download Website

from __future__ import absolute_import, division, print_function

%load_ext autoreload

%autoreload 2

%matplotlib inline

%config InlineBackend.figure_format='retina'

import sys

import os

import pandas as pd

import numpy as np

# # Remote Data Access

# import pandas_datareader.data as web

# import datetime

# # reference: https://pandas-datareader.readthedocs.io/en/latest/remote_data.html

# TSA from Statsmodels

import statsmodels.api as sm

import statsmodels.formula.api as smf

import statsmodels.tsa.api as smt

# Display and Plotting

import matplotlib.pylab as plt

import seaborn as sns

pd.set_option('display.float_format', lambda x: '%.5f' % x) # pandas

np.set_printoptions(precision=5, suppress=True) # numpy

pd.set_option('display.max_columns', 100)

pd.set_option('display.max_rows', 100)

# seaborn plotting style

sns.set(style='ticks', context='poster')

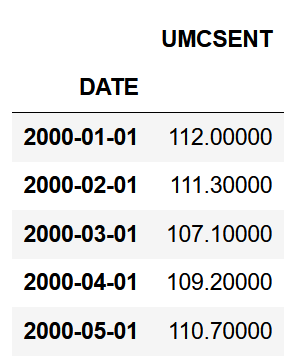

#Read the data #US consumer confidence index Sentiment = 'data/sentiment.csv' Sentiment = pd.read_csv(Sentiment, index_col=0, parse_dates=[0])

Sentiment.head()

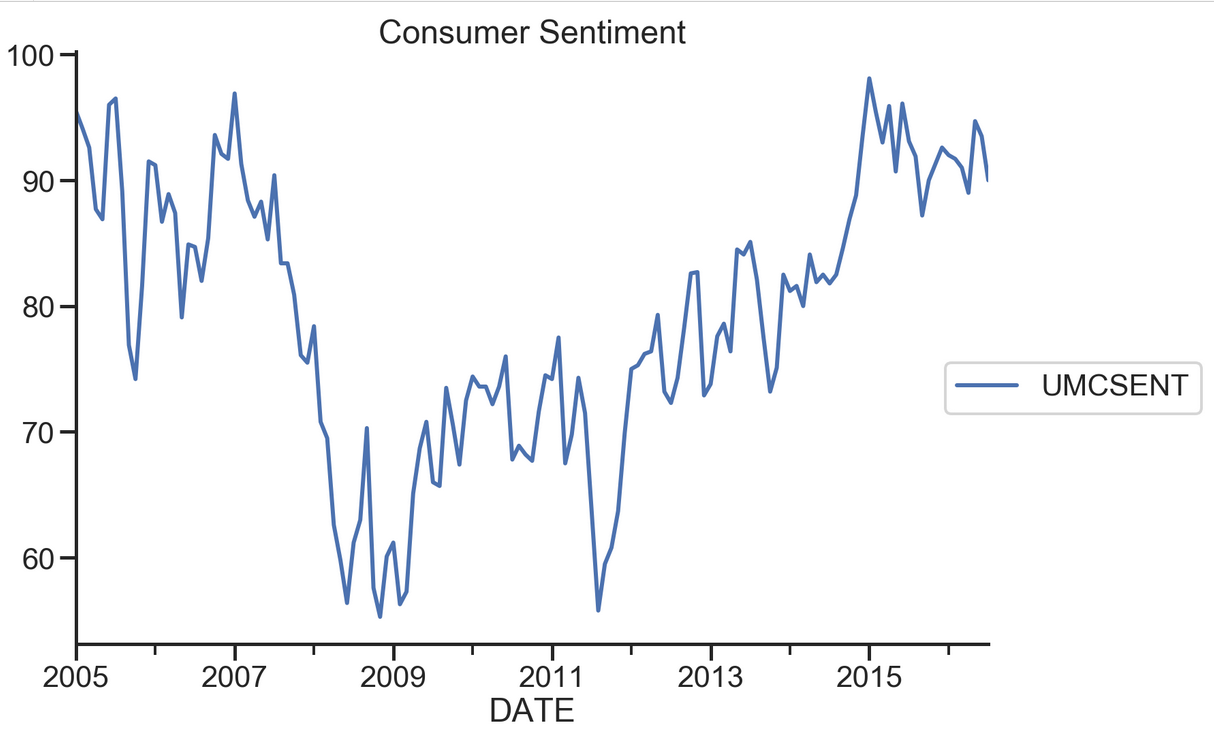

# Select the series from 2005 - 2016 sentiment_short = Sentiment.loc['2005':'2016']

sentiment_short.plot(figsize=(12,8))

plt.legend(bbox_to_anchor=(1.25, 0.5))

plt.title("Consumer Sentiment")

sns.despine()

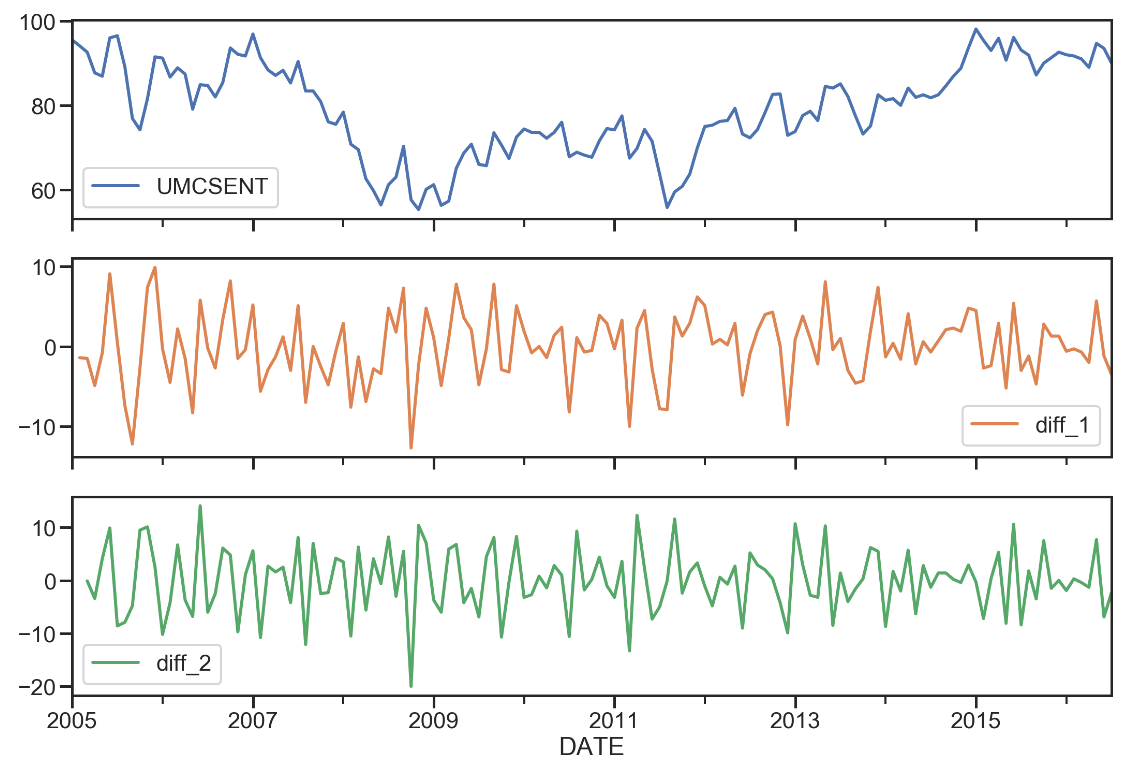

sentiment_short['diff_1'] = sentiment_short['UMCSENT'].diff(1) sentiment_short['diff_2'] = sentiment_short['diff_1'].diff(1) sentiment_short.plot(subplots=True, figsize=(18, 12))

del sentiment_short['diff_2'] del sentiment_short['diff_1'] sentiment_short.head() print (type(sentiment_short))

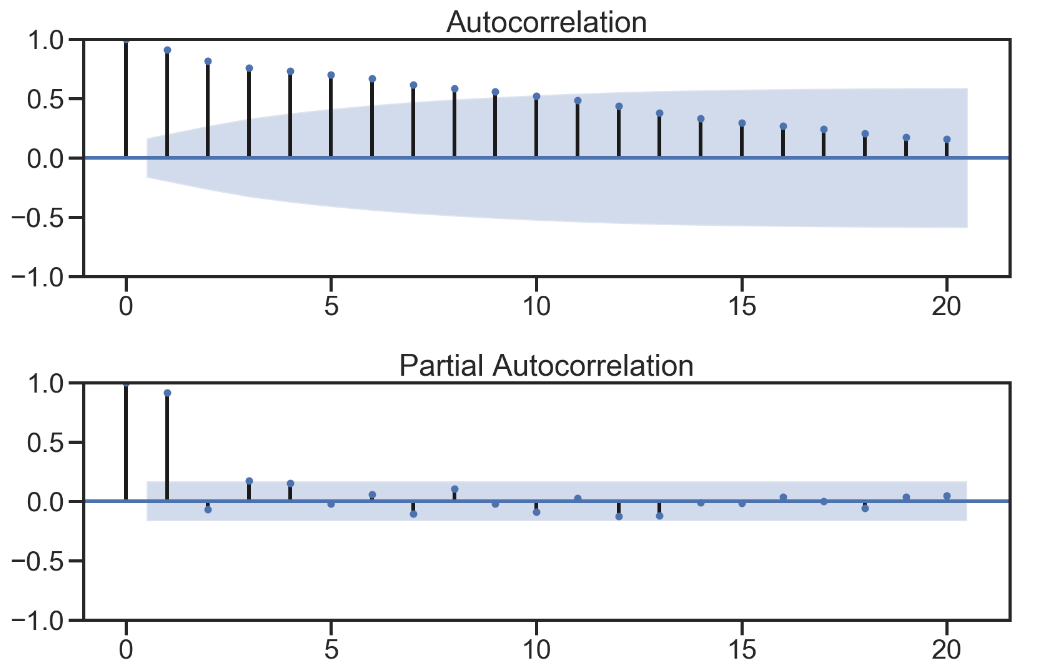

fig = plt.figure(figsize=(12,8))

ax1 = fig.add_subplot(211)

fig = sm.graphics.tsa.plot_acf(sentiment_short, lags=20,ax=ax1)

ax1.xaxis.set_ticks_position('bottom')

fig.tight_layout();

ax2 = fig.add_subplot(212)

fig = sm.graphics.tsa.plot_pacf(sentiment_short, lags=20, ax=ax2)

ax2.xaxis.set_ticks_position('bottom')

fig.tight_layout();

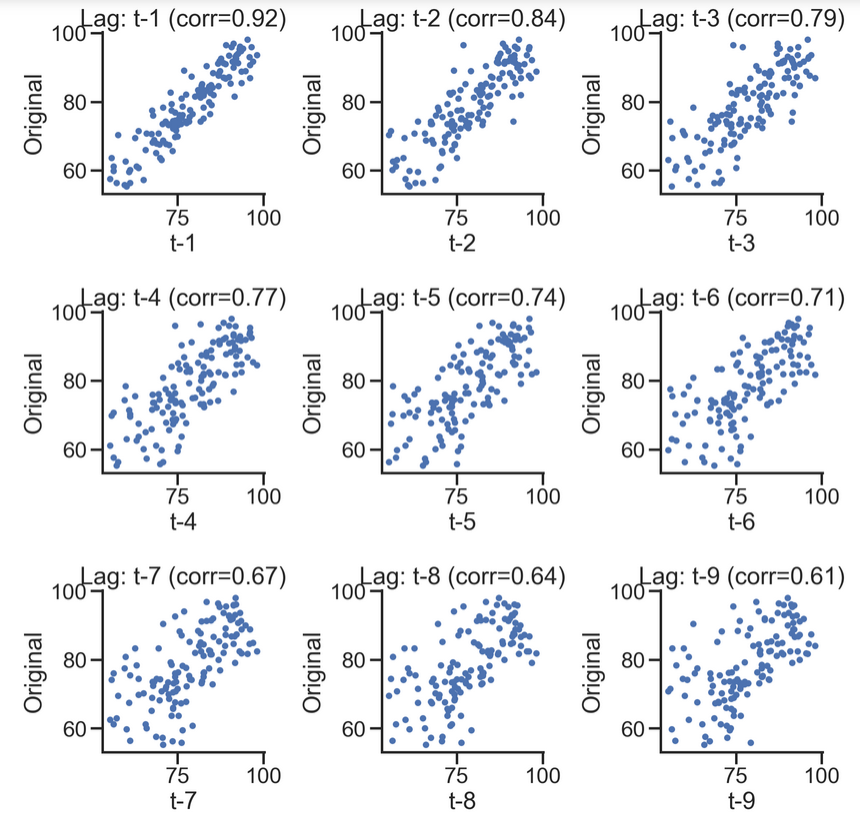

# Scatter diagrams can also represent

lags=9

ncols=3

nrows=int(np.ceil(lags/ncols))

fig, axes = plt.subplots(ncols=ncols, nrows=nrows, figsize=(4*ncols, 4*nrows))

for ax, lag in zip(axes.flat, np.arange(1,lags+1, 1)):

lag_str = 't-{}'.format(lag)

X = (pd.concat([sentiment_short, sentiment_short.shift(-lag)], axis=1,

keys=['y'] + [lag_str]).dropna())

X.plot(ax=ax, kind='scatter', y='y', x=lag_str);

corr = X.corr().iloc[:,:].values[0][1]

ax.set_ylabel('Original')

ax.set_title('Lag: {} (corr={:.2f})'.format(lag_str, corr));

ax.set_aspect('equal');

sns.despine();

fig.tight_layout();

# More intuitive

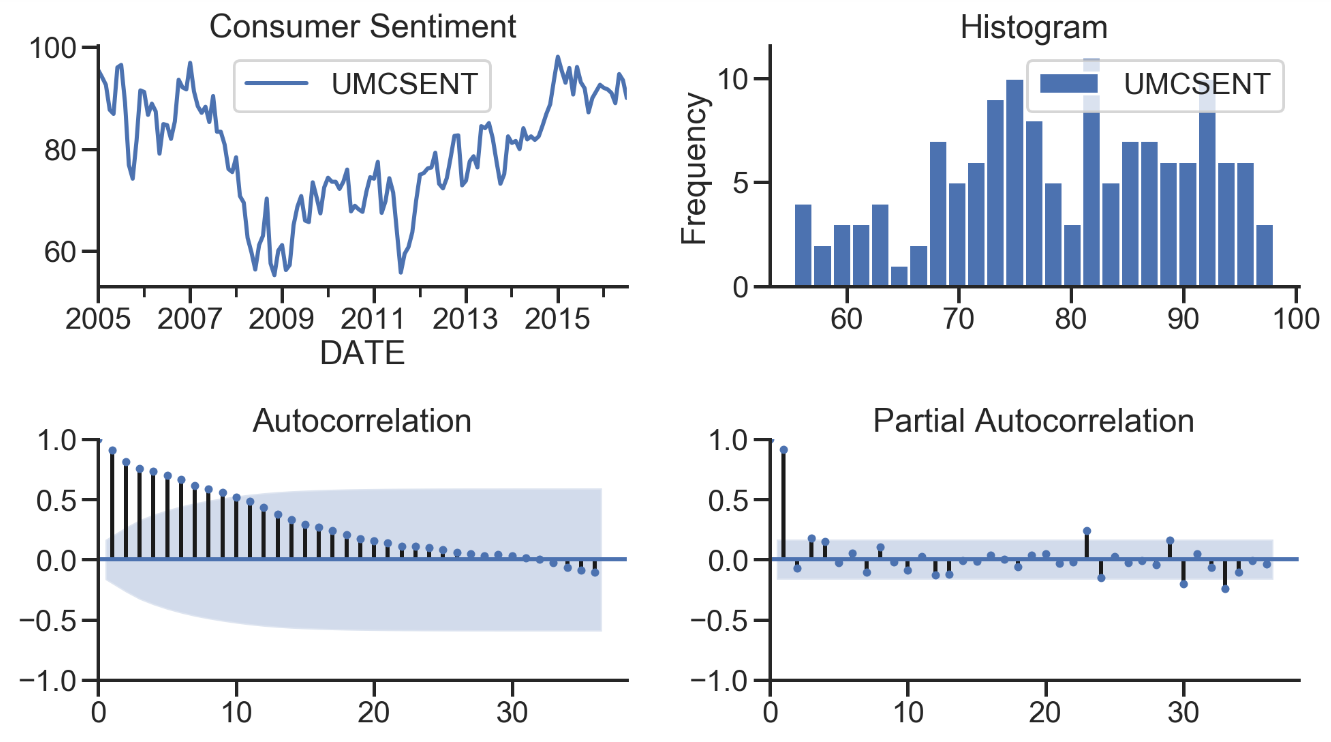

def tsplot(y, lags=None, title='', figsize=(14, 8)):

fig = plt.figure(figsize=figsize)

layout = (2, 2)

ts_ax = plt.subplot2grid(layout, (0, 0))

hist_ax = plt.subplot2grid(layout, (0, 1))

acf_ax = plt.subplot2grid(layout, (1, 0))

pacf_ax = plt.subplot2grid(layout, (1, 1))

y.plot(ax=ts_ax)

ts_ax.set_title(title)

y.plot(ax=hist_ax, kind='hist', bins=25)

hist_ax.set_title('Histogram')

smt.graphics.plot_acf(y, lags=lags, ax=acf_ax)

smt.graphics.plot_pacf(y, lags=lags, ax=pacf_ax)

[ax.set_xlim(0) for ax in [acf_ax, pacf_ax]]

sns.despine()

plt.tight_layout()

return ts_ax, acf_ax, pacf_ax

tsplot(sentiment_short, title='Consumer Sentiment', lags=36);

Parameter selection

from __future__ import absolute_import, division, print_function

%load_ext autoreload

%autoreload 2

%matplotlib inline

%config InlineBackend.figure_format='retina'

import sys

import os

import pandas as pd

import numpy as np

# TSA from Statsmodels

import statsmodels.api as sm

import statsmodels.formula.api as smf

import statsmodels.tsa.api as smt

# Display and Plotting

import matplotlib.pylab as plt

import seaborn as sns

pd.set_option('display.float_format', lambda x: '%.5f' % x) # pandas

np.set_printoptions(precision=5, suppress=True) # numpy

pd.set_option('display.max_columns', 100)

pd.set_option('display.max_rows', 100)

# seaborn plotting style

sns.set(style='ticks', context='poster')

filename_ts = 'data/series1.csv' ts_df = pd.read_csv(filename_ts, index_col=0, parse_dates=[0]) n_sample = ts_df.shape[0]

print(ts_df.shape) print(ts_df.head())

(120, 1)

value

2006-06-01 0.21507

2006-07-01 1.14225

2006-08-01 0.08077

2006-09-01 -0.73952

2006-10-01 0.53552

# Create a training sample and testing sample before analyzing the series

n_train=int(0.95*n_sample)+1

n_forecast=n_sample-n_train

#ts_df

ts_train = ts_df.iloc[:n_train]['value']

ts_test = ts_df.iloc[n_train:]['value']

print(ts_train.shape)

print(ts_test.shape)

print("Training Series:", "\n", ts_train.tail(), "\n")

print("Testing Series:", "\n", ts_test.head())

(115,)

(5,)

Training Series:

2015-08-01 0.60371

2015-09-01 -1.27372

2015-10-01 -0.93284

2015-11-01 0.08552

2015-12-01 1.20534

Name: value, dtype: float64

Testing Series:

2016-01-01 2.16411

2016-02-01 0.95226

2016-03-01 0.36485

2016-04-01 -2.26487

2016-05-01 -2.38168

Name: value, dtype: float64

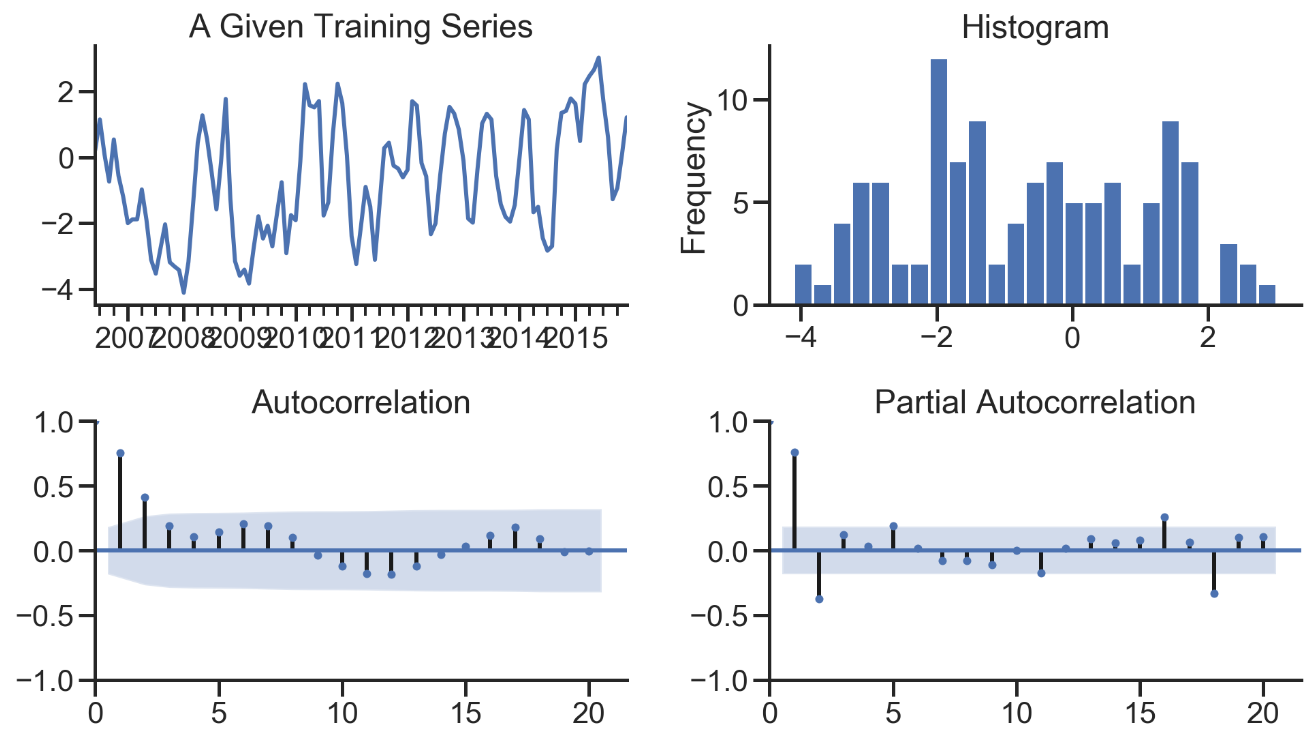

def tsplot(y, lags=None, title='', figsize=(14, 8)):

fig = plt.figure(figsize=figsize)

layout = (2, 2)

ts_ax = plt.subplot2grid(layout, (0, 0))

hist_ax = plt.subplot2grid(layout, (0, 1))

acf_ax = plt.subplot2grid(layout, (1, 0))

pacf_ax = plt.subplot2grid(layout, (1, 1))

y.plot(ax=ts_ax)

ts_ax.set_title(title)

y.plot(ax=hist_ax, kind='hist', bins=25)

hist_ax.set_title('Histogram')

smt.graphics.plot_acf(y, lags=lags, ax=acf_ax)

smt.graphics.plot_pacf(y, lags=lags, ax=pacf_ax)

[ax.set_xlim(0) for ax in [acf_ax, pacf_ax]]

sns.despine()

fig.tight_layout()

return ts_ax, acf_ax, pacf_ax

tsplot(ts_train, title='A Given Training Series', lags=20);

#Model Estimation # Fit the model arima200 = sm.tsa.SARIMAX(ts_train, order=(2,0,0)) model_results = arima200.fit()

import itertools

p_min = 0

d_min = 0

q_min = 0

p_max = 4

d_max = 0

q_max = 4

# Initialize a DataFrame to store the results

results_bic = pd.DataFrame(index=['AR{}'.format(i) for i in range(p_min,p_max+1)],

columns=['MA{}'.format(i) for i in range(q_min,q_max+1)])

for p,d,q in itertools.product(range(p_min,p_max+1),

range(d_min,d_max+1),

range(q_min,q_max+1)):

if p==0 and d==0 and q==0:

results_bic.loc['AR{}'.format(p), 'MA{}'.format(q)] = np.nan

continue

try:

model = sm.tsa.SARIMAX(ts_train, order=(p, d, q),

#enforce_stationarity=False,

#enforce_invertibility=False,

)

results = model.fit()

results_bic.loc['AR{}'.format(p), 'MA{}'.format(q)] = results.bic

except:

continue

results_bic = results_bic[results_bic.columns].astype(float)

fig, ax = plt.subplots(figsize=(10, 8))

ax = sns.heatmap(results_bic,

mask=results_bic.isnull(),

ax=ax,

annot=True,

fmt='.2f',

);

ax.set_title('BIC');

# Alternative model selection method, limited to only searching AR and MA parameters

train_results = sm.tsa.arma_order_select_ic(ts_train, ic=['aic', 'bic'], trend='n', max_ar=4, max_ma=4)

print('AIC', train_results.aic_min_order)

print('BIC', train_results.bic_min_order)

AIC (4, 4)

BIC (4, 4)

#Residual analysis normal distribution QQ linear graph model_results.plot_diagnostics(figsize=(16, 12));

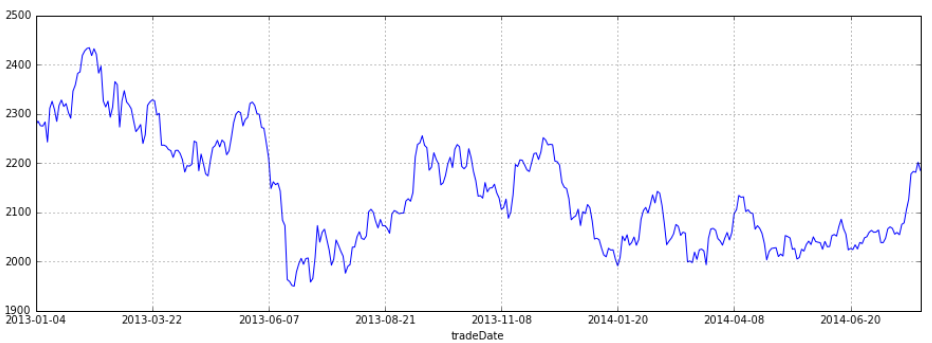

Time series prediction with ARIMA model - stock prediction

%matplotlib inline

import pandas as pd

import pandas_datareader

import datetime

import matplotlib.pylab as plt

import seaborn as sns

from matplotlib.pylab import style

# from statsmodels.tsa.arima_model import ARIMA

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

style.use('ggplot')

plt.rcParams['font.sans-serif'] = ['SimHei']

plt.rcParams['axes.unicode_minus'] = False

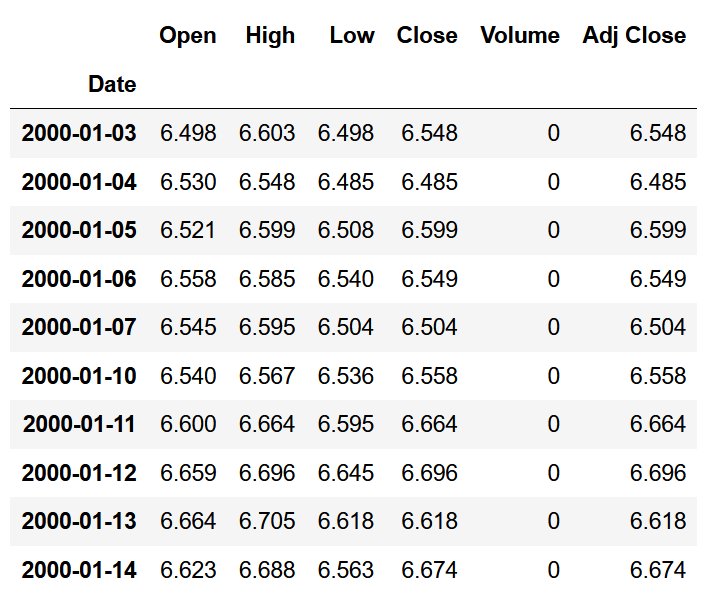

stockFile = 'data/T10yr.csv' stock = pd.read_csv(stockFile, index_col=0, parse_dates=[0]) stock.head(10)

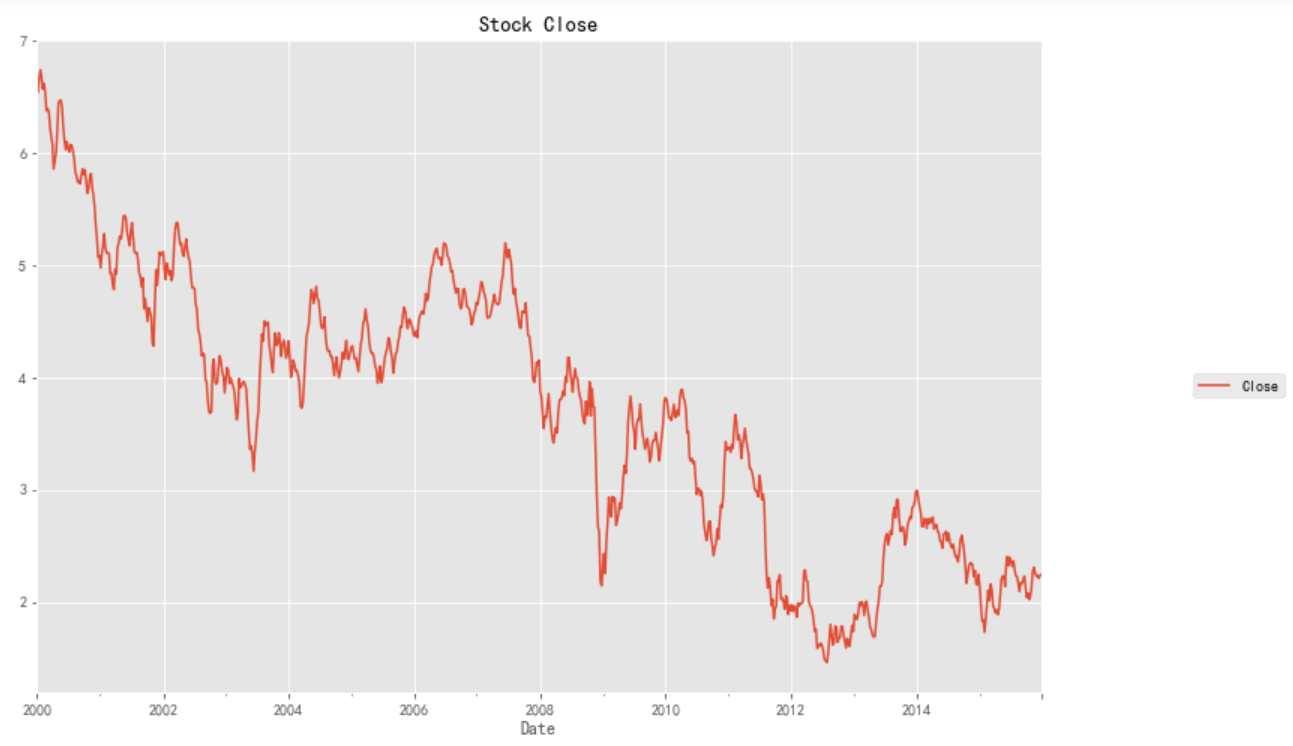

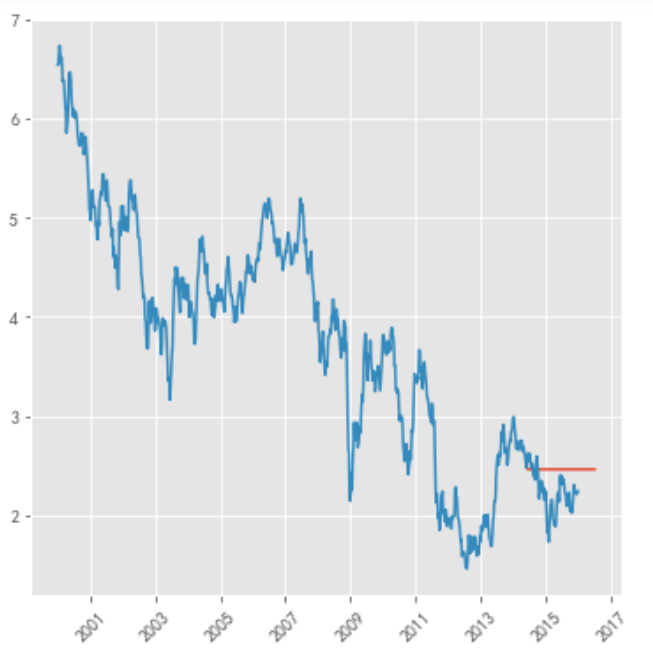

stock_week = stock['Close'].resample('W-MON').mean()

stock_train = stock_week['2000':'2015']

stock_train.plot(figsize=(12,8))

plt.legend(bbox_to_anchor=(1.25, 0.5))

plt.title("Stock Close")

sns.despine()

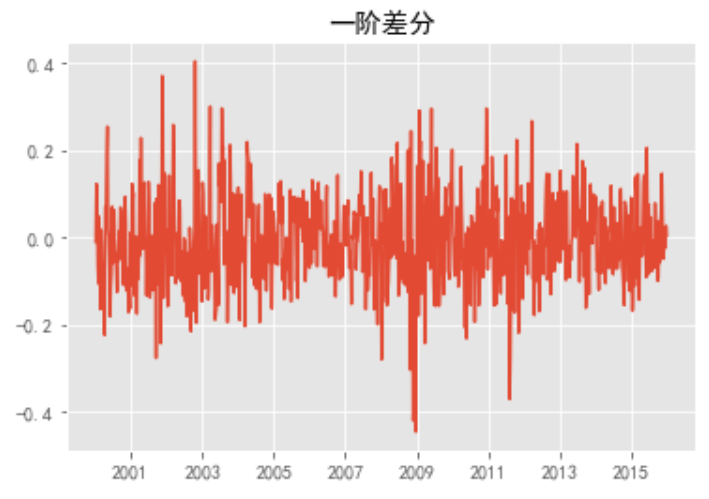

stock_diff = stock_train.diff()

stock_diff = stock_diff.dropna()

plt.figure()

plt.plot(stock_diff)

plt.title('First order difference')

plt.show()

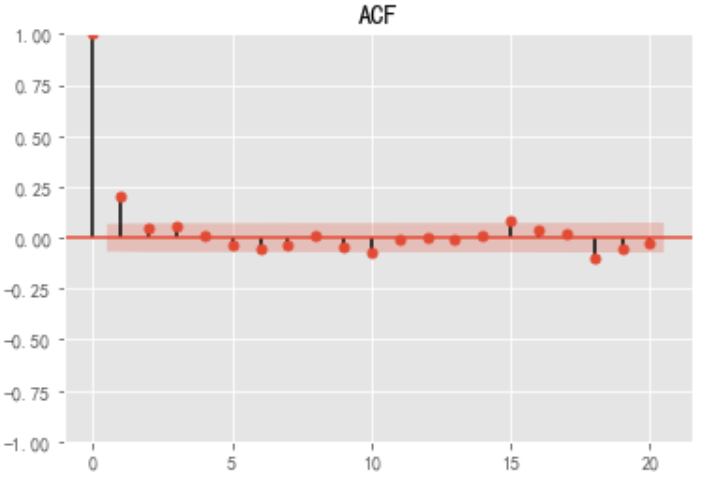

acf = plot_acf(stock_diff, lags=20)

plt.title("ACF")

acf.show()

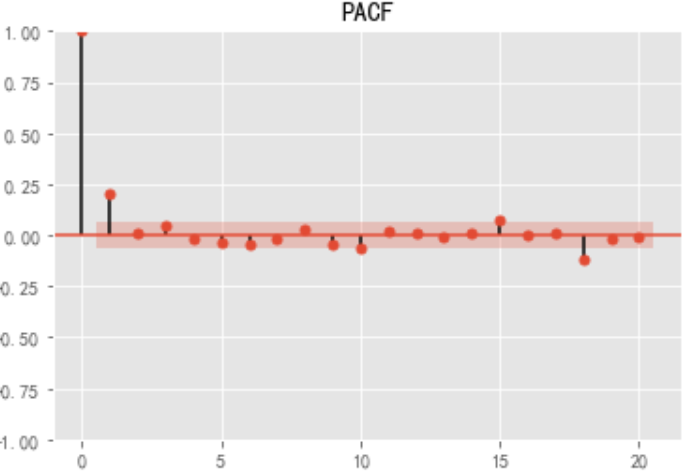

pacf = plot_pacf(stock_diff, lags=20)

plt.title("PACF")

pacf.show()

import statsmodels.api as sm model = sm.tsa.arima.ARIMA(stock_train, order=(1, 1, 1),freq='W-MON')

result = model.fit() #print(result.summary())

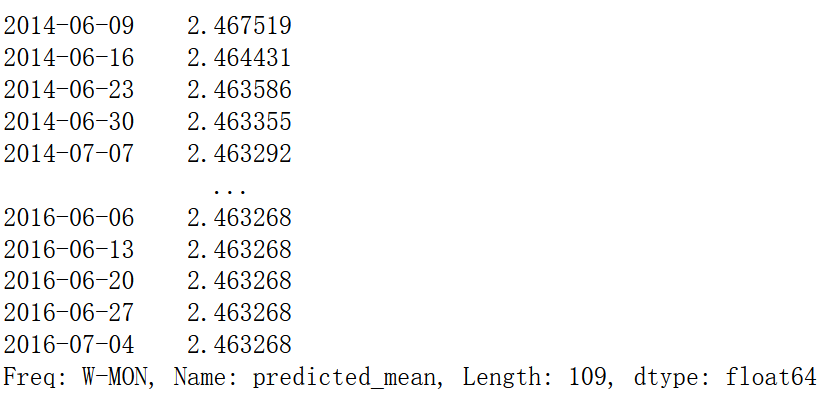

pred = result.predict('20140609', '20160701',dynamic=True, typ='levels')

print (pred)

plt.figure(figsize=(6, 6)) plt.xticks(rotation=45) plt.plot(pred) plt.plot(stock_train)

Use tsfresh library for classification tasks

Problems encountered installing tsfresh

I really took it. There was no tsfresh library on that website, so I had to pip install tsfresh, but there was an error. I don't know why the installation failed. Then I reinstalled and encountered some problems,

1. To solve the problem that "llvmlite" cannot be installed and uninstalled, you need to go to anaconda3 → Lib → site packages, find the corresponding old version file, and delete it directly. (the following is what I deleted)

Reference blog https://blog.csdn.net/wasjrong/article/details/108419050

2 is an ERROR: Could not install packages due to an EnvironmentError: [WinError 5] access is denied. You need to add -- user + the name of the package to be installed after pip install, for example

pip install --user tsfresh

Sometimes I really hate direct pip install. I really hope the library website can collect more libraries, so there won't be so many problems when downloading.

test

%matplotlib inline import matplotlib.pylab as plt import seaborn as sns from tsfresh.examples.robot_execution_failures import download_robot_execution_failures, load_robot_execution_failures from tsfresh import extract_features, extract_relevant_features, select_features from tsfresh.utilities.dataframe_functions import impute from tsfresh.feature_extraction import ComprehensiveFCParameters from sklearn.tree import DecisionTreeClassifier from sklearn.model_selection import train_test_split from sklearn.metrics import classification_report #http://tsfresh.readthedocs.io/en/latest/text/quick_start.html Document introduction

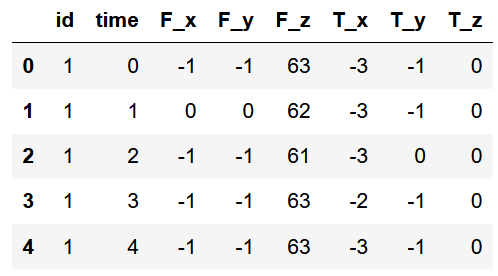

# An error ConnectionError will be reported here: # Reference articles https://blog.csdn.net/The_Time_Runner/article/details/110248835 download_robot_execution_failures() df, y = load_robot_execution_failures() df.head()

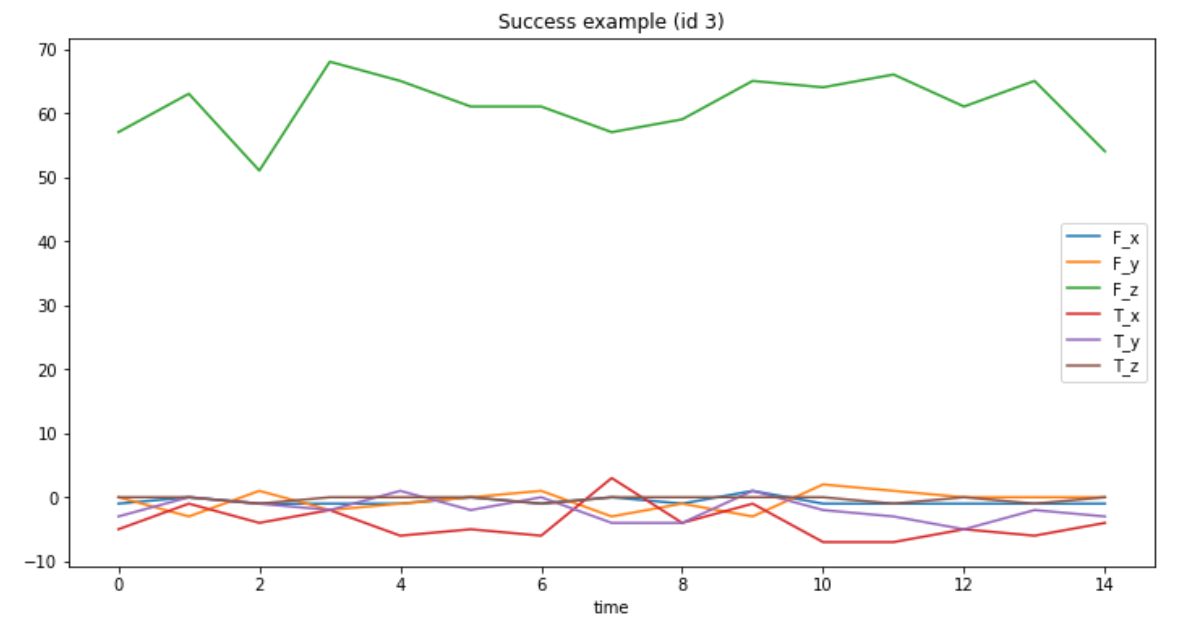

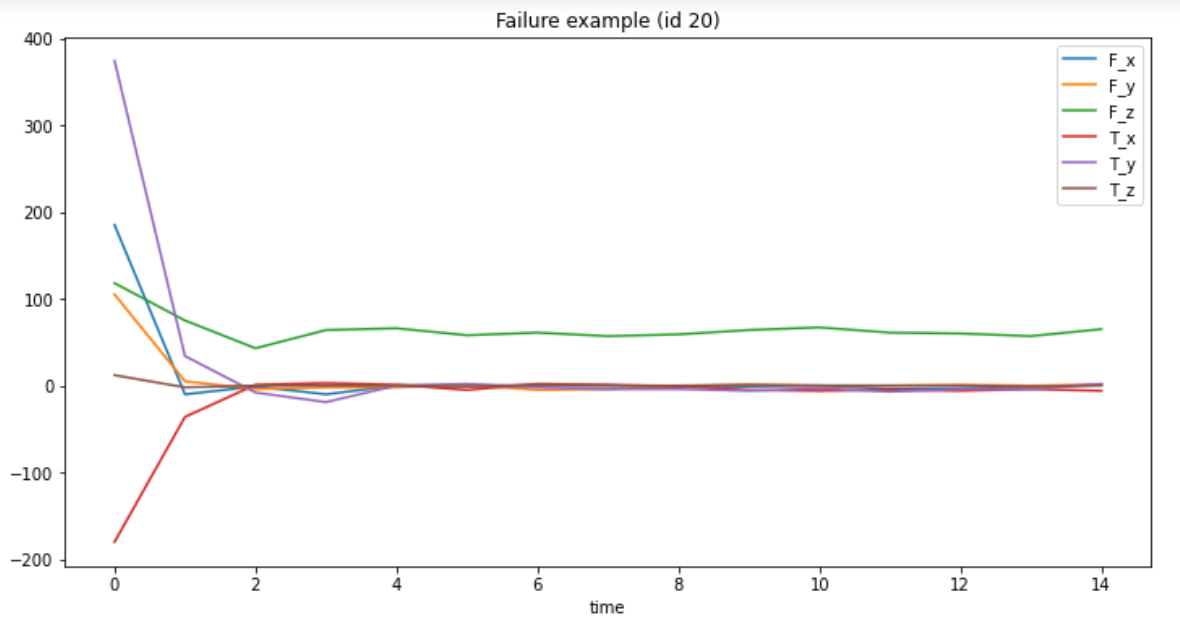

df[df.id == 3][['time', 'F_x', 'F_y', 'F_z', 'T_x', 'T_y', 'T_z']].plot(x='time', title='Success example (id 3)', figsize=(12, 6)); df[df.id == 20][['time', 'F_x', 'F_y', 'F_z', 'T_x', 'T_y', 'T_z']].plot(x='time', title='Failure example (id 20)', figsize=(12, 6));

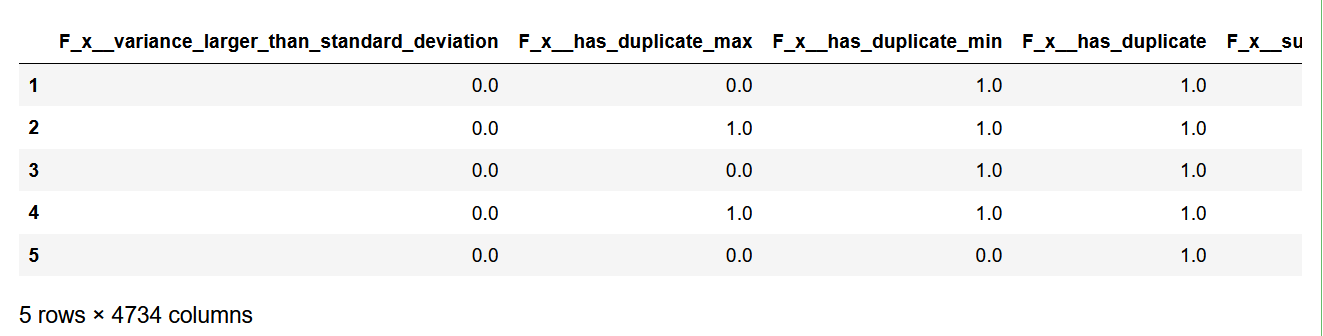

extraction_settings = ComprehensiveFCParameters()

#column_id (str) – The name of the id column to group by

#column_sort (str) – The name of the sort column.

X = extract_features(df,

column_id='id', column_sort='time',

default_fc_parameters=extraction_settings,

impute_function= impute)

X.head()

X.info()

<class 'pandas.core.frame.DataFrame'>

Int64Index: 88 entries, 1 to 88

Columns: 4734 entries, F_x__variance_larger_than_standard_deviation to T_z__mean_n_absolute_max__number_of_maxima_7

dtypes: float64(4734)

memory usage: 3.2 MB

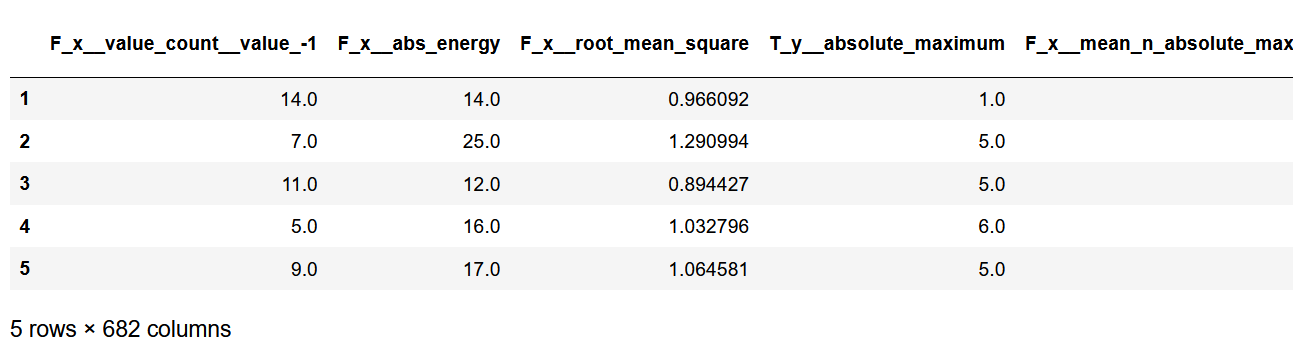

X_filtered = extract_relevant_features(df, y,

column_id='id', column_sort='time',

default_fc_parameters=extraction_settings)

X_filtered.head()

X_filtered.info()

<class 'pandas.core.frame.DataFrame'>

Int64Index: 88 entries, 1 to 88

Columns: 682 entries, F_x__value_count__value_-1 to T_z__quantile__q_0.9

dtypes: float64(682)

memory usage: 469.6 KB

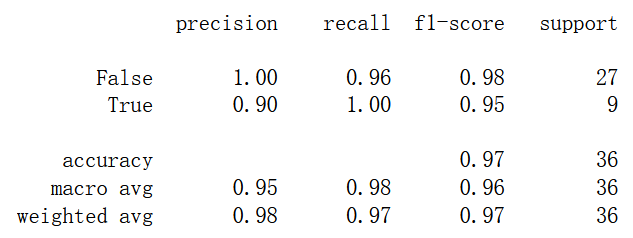

X_train, X_test, X_filtered_train, X_filtered_test, y_train, y_test = train_test_split(X, X_filtered, y, test_size=.4)

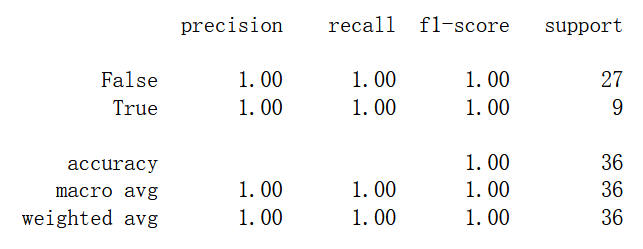

cl = DecisionTreeClassifier() cl.fit(X_train, y_train) print(classification_report(y_test, cl.predict(X_test)))

cl.n_features_

4734

cl2 = DecisionTreeClassifier() cl2.fit(X_filtered_train, y_train) print(classification_report(y_test, cl2.predict(X_filtered_test)))

cl2.n_features_

682

Wikipedia entry EDA

import pandas as pd import numpy as np import matplotlib.pyplot as plt import re %matplotlib inline

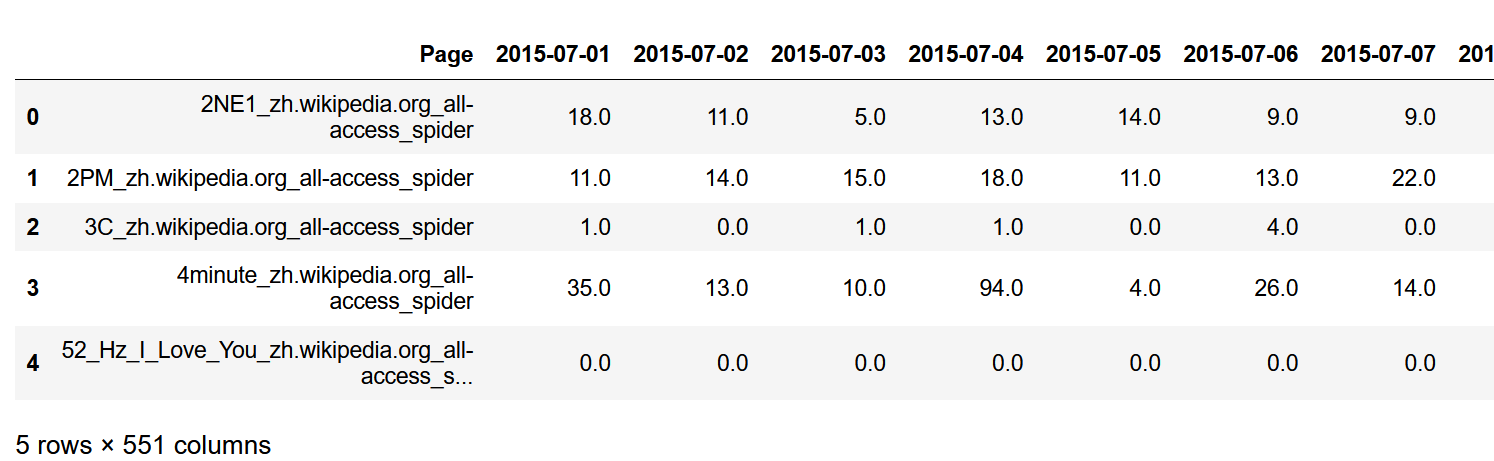

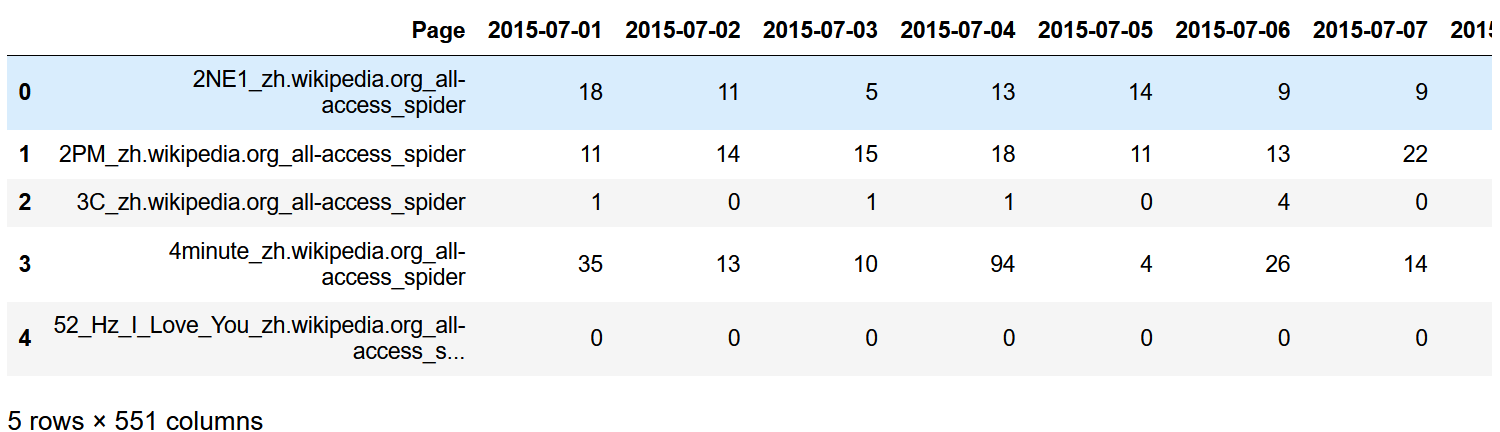

train = pd.read_csv('train_1.csv').fillna(0)

train.head()

train.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 145063 entries, 0 to 145062

Columns: 551 entries, Page to 2016-12-31

dtypes: float64(550), object(1)

memory usage: 609.8+ MB

for col in train.columns[1:]:

train[col] = pd.to_numeric(train[col],downcast='integer')

train.head()

train.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 145063 entries, 0 to 145062

Columns: 551 entries, Page to 2016-12-31

dtypes: int32(550), object(1)

memory usage: 305.5+ MB

def get_language(page):

res = re.search('[a-z][a-z].wikipedia.org',page)

#print (res.group()[0:2])

if res:

return res.group()[0:2]

return 'na'

train['lang'] = train.Page.map(get_language)

from collections import Counter

print(Counter(train.lang))

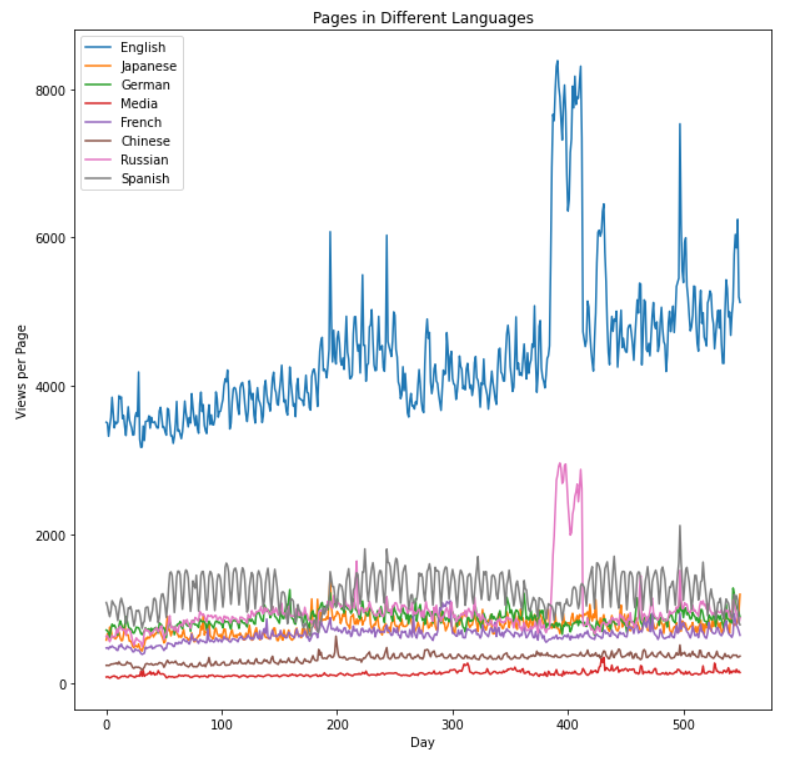

Counter({'en': 24108, 'ja': 20431, 'de': 18547, 'na': 17855, 'fr': 17802, 'zh': 17229, 'ru': 15022, 'es': 14069})

lang_sets = {}

lang_sets['en'] = train[train.lang=='en'].iloc[:,0:-1]

lang_sets['ja'] = train[train.lang=='ja'].iloc[:,0:-1]

lang_sets['de'] = train[train.lang=='de'].iloc[:,0:-1]

lang_sets['na'] = train[train.lang=='na'].iloc[:,0:-1]

lang_sets['fr'] = train[train.lang=='fr'].iloc[:,0:-1]

lang_sets['zh'] = train[train.lang=='zh'].iloc[:,0:-1]

lang_sets['ru'] = train[train.lang=='ru'].iloc[:,0:-1]

lang_sets['es'] = train[train.lang=='es'].iloc[:,0:-1]

sums = {}

for key in lang_sets:

sums[key] = lang_sets[key].iloc[:,1:].sum(axis=0) / lang_sets[key].shape[0]

days = [r for r in range(sums['en'].shape[0])]

fig = plt.figure(1,figsize=[10,10])

plt.ylabel('Views per Page')

plt.xlabel('Day')

plt.title('Pages in Different Languages')

labels={'en':'English','ja':'Japanese','de':'German',

'na':'Media','fr':'French','zh':'Chinese',

'ru':'Russian','es':'Spanish'

}

for key in sums:

plt.plot(days,sums[key],label = labels[key] )

plt.legend()

plt.show()

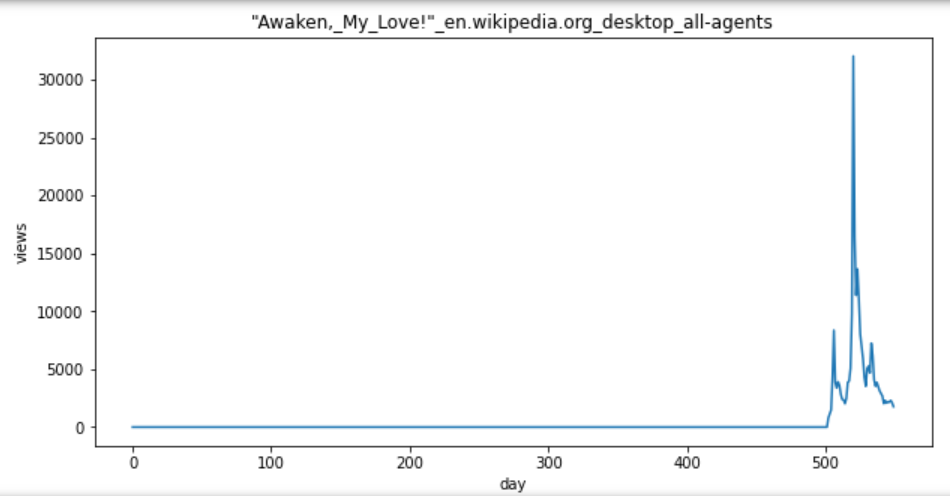

def plot_entry(key,idx):

data = lang_sets[key].iloc[idx,1:]

fig = plt.figure(1,figsize=(10,5))

plt.plot(days,data)

plt.xlabel('day')

plt.ylabel('views')

plt.title(train.iloc[lang_sets[key].index[idx],0])

plt.show()

idx = [1, 5, 10, 50, 100, 250,500, 750,1000,1500,2000,3000,4000,5000]

for i in idx:

plot_entry('en',i)

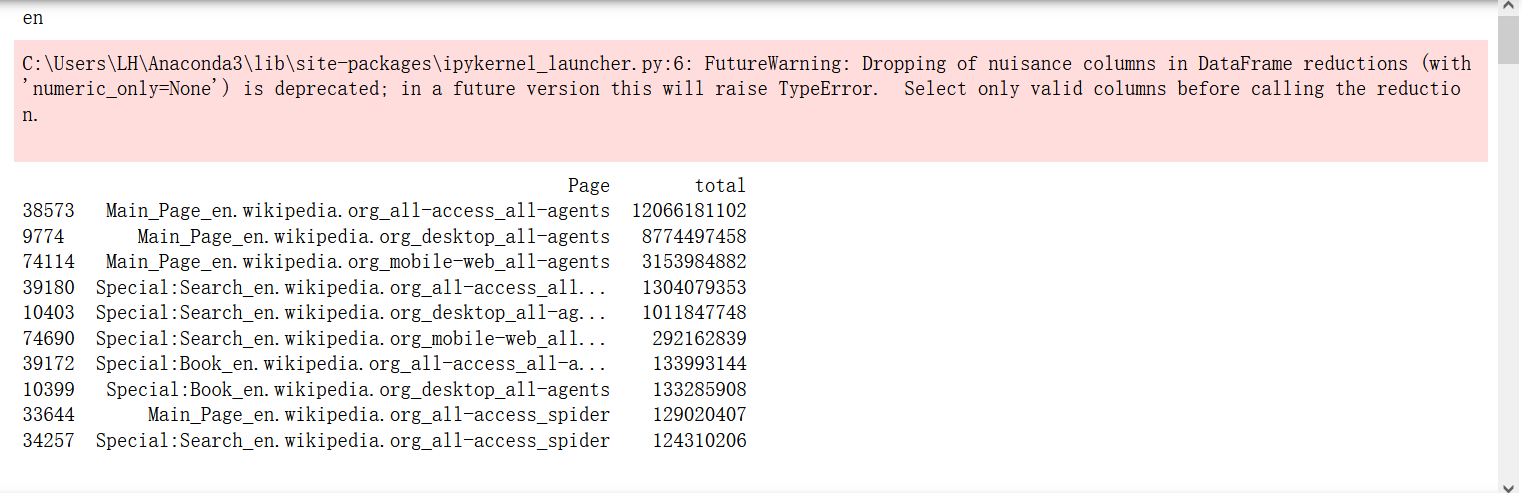

npages = 5

top_pages = {}

for key in lang_sets:

print(key)

sum_set = pd.DataFrame(lang_sets[key][['Page']])

sum_set['total'] = lang_sets[key].sum(axis=1)

sum_set = sum_set.sort_values('total',ascending=False)

print(sum_set.head(10))

top_pages[key] = sum_set.index[0]

print('\n\n')

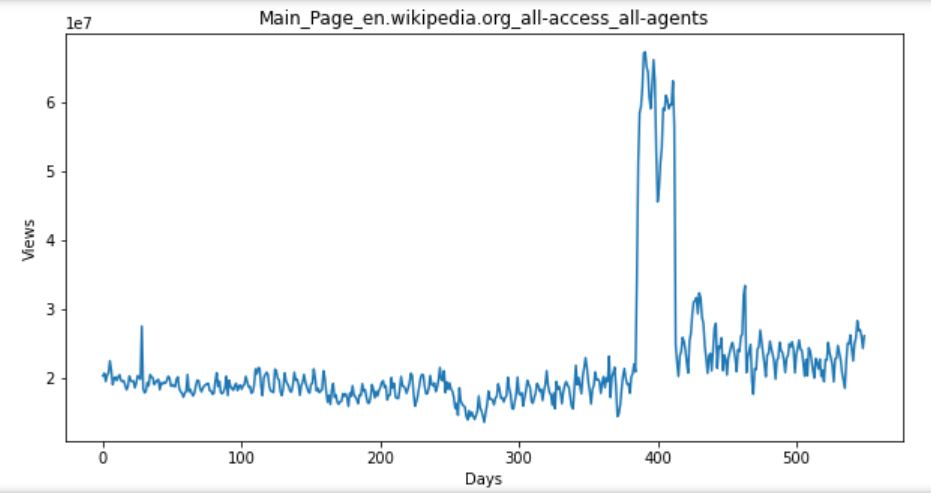

for key in top_pages:

fig = plt.figure(1,figsize=(10,5))

cols = train.columns

cols = cols[1:-1]

data = train.loc[top_pages[key],cols]

plt.plot(days,data)

plt.xlabel('Days')

plt.ylabel('Views')

plt.title(train.loc[top_pages[key],'Page'])

plt.show()

Solutions to problems encountered

-

for train_k, test_k in KFold(len(train_kobe), n_folds=10, shuffle=True): many errors will be reported

Need to be changed to for train_k, test_k in KFold(10, shuffle=True).split(train_kobe): -

NameError: name 'dt' is not defined

Package not imported: import datetime as dt -

AttributeError: 'DataFrame' object has no attribute 'as_matrix'

Set corr = x.corr() as_ Matrix() [0] [1] changed to corr = x.corr() iloc[:,:]. values[0][1] -

ModuleNotFoundError: No module named 'pandas_datareader'

Generally, PIP install pandas is not installed_ datareader

-

model = ARIMA(stock_train, order=(1, 1, 1),freq = 'W-MON') reports an error notimplementederror: statsmodes tsa. arima_ model. ARMA and statsmodels. tsa. arima_ model. ARIMA have been removed in favor of statsmodels. tsa. arima. model. ARIMA (note the . between arima and model) and statsmodels. tsa. SARIMAX.

This is due to the abandonment of ARIMA package "statsmodes \ TSA \ arima_model".

So put this from stats models tsa. arima_ Model import Arima annotation, changed to import statsmodes API as SM, changed to model = SM when referenced tsa. arima. ARIMA(stock_train, order=(1, 1, 1),freq=‘W-MON’)

reference resources: https://stackoverflow.com/questions/67601211/futurewarning-statsmodels-tsa-arima-model-arma-and-statsmodels-tsa-arima-model -

download_robot_execution_failures() reported an error ConnectionError:

open https://github.com/MaxBenChrist/robot-failure-dataset/blob/master/lp1.data.txt , in https://github.com/MaxBenChrist/robot-failure-dataset Download code manually and Lp1 data. Txt manually copy to ~ / anaconda3 / lib / python3 8 / site packages / tsfresh / examples / data / robot failure MLD and renamed Lp1 data.

Reference articles https://blog.csdn.net/The_Time_Runner/article/details/110248835